CenturyLink 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

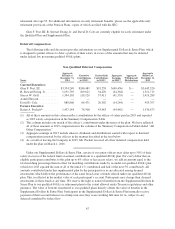

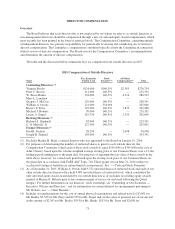

DIRECTOR COMPENSATION

Overview

The Board believes that each director who is not employed by us (whom we refer to as outside directors or

non-management directors) should be compensated through a mix of cash and equity-based compensation, which

most recently has been granted in the form of restricted stock. The Compensation Committee, consisting entirely

of independent directors, has primary responsibility for periodically reviewing and considering any revisions to

director compensation. The Committee’s compensation consultant typically assists the Committee in connection

with its review of director compensation. The Board reviews the Compensation Committee’s recommendations

and determines the amount of director compensation.

The table and the discussion below summarize how we compensated our outside directors in 2015.

2015 Compensation of Outside Directors

Name

Fees Earned or

Paid in Cash

Stock

Awards(2),(3)

All Other

Compensation(4) Total

Continuing Directors:(1)

Virginia Boulet ..................... $134,000 $140,391 $2,363 $276,754

Peter C. Brown ..................... 111,000 140,391 — 251,391

W. Bruce Hanks .................... 138,000 140,391 4,514 282,905

Mary L. Landrieu ................... — — — —

Gregory J. McCray .................. 129,000 140,391 — 269,391

William A. Owens ................... 121,000 334,006 — 455,006

Harvey P. Perry ..................... 197,000 140,391 3,875 341,266

Michael J. Roberts ................... 99,000 140,391 — 239,391

Laurie A. Siegel ..................... 119,750 140,391 2,555 262,696

Retiring Directors:(5)

Richard A. Gephardt ................. 83,000 140,391 — 223,391

C. G. Melville, Jr. ................... 127,500 140,391 — 267,891

Former Directors:(6)

Fred R. Nichols ..................... 28,250 — 2,698 30,948

Joseph R. Zimmel ................... 103,000 140,391 — 243,391

(1) Excludes Martha H. Bejar, a current director who was appointed to the Board on January 19, 2016.

(2) For purposes of determining the number of restricted shares to grant to each outside director, the

Compensation Committee valued each of these stock awards to equal $145,000 (or $345,000 in the case of

Adm. Owens), based upon the volume-weighted average closing price of our Common Shares over a 15-day

trading period ending prior to the grant date. For purposes of reporting the fair value of these awards in the

table above, however, we valued each grant based upon the closing stock price of our Common Shares on

the grant date in accordance with FASB ASC Topic 718. These grants vest on May 21, 2016 (subject to

accelerated vesting or forfeiture in certain limited circumstances). See “— Cash and Stock Payments.”

(3) As of December 31, 2015, William A. Owens held 9,752 unvested shares of restricted stock and each of our

other outside directors then in office held 4,099 unvested shares of restricted stock, which constituted the

only unvested equity-based awards held by our outside directors as of such date (excluding equity awards

granted to Michael J. Roberts prior to his commencement of service on our board following the Qwest

merger). For further information on our directors’ stock ownership, see “Ownership of Our Securities —

Executive Officers and Directors,” and for information on certain deferred fee arrangements pertaining to

Mr. Roberts, see “— Other Benefits.”

(4) Includes (i) reimbursements for the cost of annual physical examinations and related travel of $3,961 for

Mr. Hanks, $3,322 for Mr. Perry and $2,555 for Ms. Siegel and (ii) the value of personal use of our aircraft

in the amount of $2,363 for Ms. Boulet, $553 for Mr. Hanks, $553 for Mr. Perry and $2,698 for

73