CenturyLink 2015 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

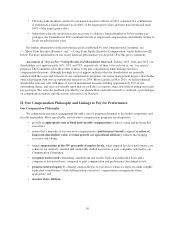

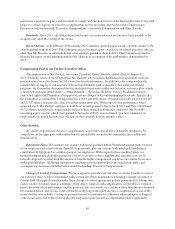

Linkage of Long-Term Incentive Performance Objectives with our Compensation Philosophy. We believe

we can increase shareholder value by outperforming our industry peers’ three-year total shareholder return and

consistently achieving and surpassing the sum of our annual revenue targets over three-year performance periods.

Since 2013, the Committee has granted performance-based restricted stock measuring our performance against

these two objectives over a three-year performance period. In 2014, the Committee increased the percentage of

the value of the executives’ long-term awards in the form of performance-based restricted stock from 50% to

60%.

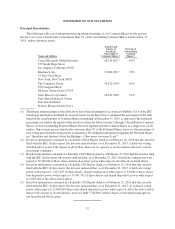

The percentages in the tables below represent the percentage of the target value of the executives’ long-term

awards granted in the form of performance-based restricted stock and time-vested restricted stock, including, for

grant years 2013 and later, the portion based upon total shareholder return and absolute revenue performance

objectives.

Grant Date Allocation of Long-Term Incentive Awards

Grant

Year

Performance

Period

% of Total Fair

Value Awarded in

Time-Vested

Restricted Shares

% of Total Fair

Value Awarded in

TSR Performance-

Based Restricted

Shares(1)

% of Total Fair

Value Awarded in

Absolute Revenue

Performance-Based

Restricted Shares

2010 ............................... 2010 — 2012 50% 50% —

2011 ............................... 2011 — 2013 50% 50% —

2012 ............................... 2012 — 2014 50% 50% —

2013 ............................... 2013 — 2015 50% 25% 25%

2014 ............................... 2014 — 2016 40% 30% 30%

2015 ............................... 2015 — 2017 40% 30% 30%

(1) As noted in the table and commentary below, the applicable TSR peer group was the S&P 500 index prior to

2013, and a self-constructed peer group since then.

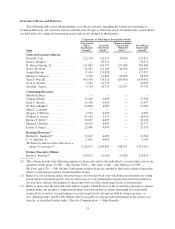

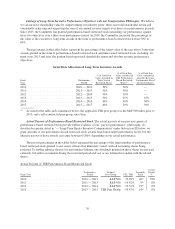

Actual Payouts of Performance-Based Restricted Stock. The actual payouts of our previous grants of

performance-based restricted stock provide further evidence of our “pay for performance” philosophy. As

described in greater detail in “— Long-Term Equity Incentive Compensation” under Subsection III below, we

grant amounts of our performance-based restricted stock awards based upon target performance levels, but the

ultimate payout of those awards can range between 0-200% depending on our actual performance.

The payout percentages in the tables below represent the percentage of the target number of performance-

based restricted stock granted to our senior officers that ultimately vested, with all remaining shares being

forfeited. To further enhance the pay for performance linkage, any dividends granted on these shares are not paid

currently, but rather accumulate during the restricted period and vest or are forfeited in tandem with the related

shares.

Actual Payouts of TSR Performance-Based Restricted Stock

Grant Year

Performance

Period

Defined

Peer Group CTL TSR

Percentile

Rank

Actual

Payout

%

2010 ................................... 2010 — 2012 S&P 500 35.29% 46th 92%

2011 ................................... 2011 — 2013 S&P 500 -14.42% 9th 0%

2012 ................................... 2012 — 2014 S&P 500 33.32% 19th 0%

2013 ................................... 2013 — 2015 TSR Peer Group -19.47% 16th 0%

39