CenturyLink 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

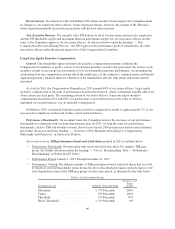

selected individual performance objectives and (iv) the officer’s individual scoring under our management

performance rating system.

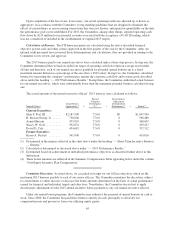

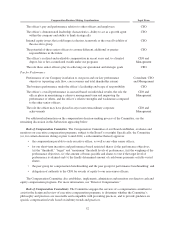

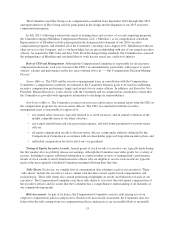

2015 Performance Results. In February 2016, the Compensation Committee reviewed audited results of the

Company’s performance as compared to the financial performance targets established for 2015. Based on the

calculations described below, the Committee determined that the aggregate earned performance for these

performance targets was 77.6% for our named executive officers, as described further below.

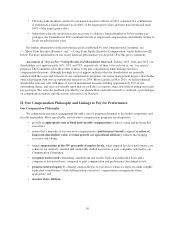

During 2015, we achieved the financial results described below which, based on the financial objective

payout scale in the table below under heading “— Calculation of Bonuses,” resulted in the following earned

performance level for each financial objective:

$6.74

$6.56

$6.90

$7.25

2015 Q4 STI Threshold STI Target

STI Maximum

2015 Operating Cash Flow (in billions)

$16.10

$15.78

$16.35

$16.92

2015 Q4 STI Threshold STI Target STI Maximum

2015 Core Revenue (in billions)

200% Payout

100% Payout

50% Payout

100% Payout

200% Payout

50% Payout

77.4%

Payout 77.7%

Payout

•162(m) Target — Operating Cash Flow Return on Average Assets. We attained a 13.9% operating cash

flow return on average assets, which exceeded the target level established by the Committee in

February 2015 for purposes of fixing the maximum amount of potential annual bonuses for 2015

payable to our senior officers in accordance with Section 162(m) of the Internal Revenue Code.

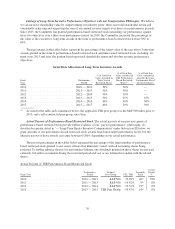

•Operating Cash Flow. We achieved consolidated operating cash flow results of $6.7445 billion (which

excludes certain revenue associated with our acceptance of CAF II funding for the reasons noted

below), which was slightly below our target of $6.9 billion, thereby resulting in earned performance of

77.54% of the target level.

•Core Revenue. We achieved consolidated core revenue results of $16.095 billion, which was slightly

below our target of $16.35 billion, thereby resulting in earned performance of 77.7% of the target level.

•Individual Performance Objectives. The Committee reviewed with management the degree to which

each senior officer met certain specific individual performance objectives and benchmarks, as well as

qualitative assessments of each officer’s performance. Based on these assessments, the Committee

elected not to make individual performance adjustments for any of our named executive officers.

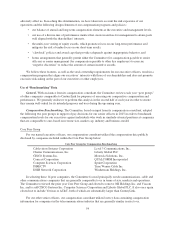

We used the following scale, which was approved in 2015, to calculate bonus amounts payable with respect

to company performance.

Financial Objective Payout Scale

Performance Level

Consolidated

Operating

Cash Flow

Consolidated

Core

Revenue

Percentage

of Earned

Performance

Maximum ................................ ≥105.0% ≥103.5% 200%

Target ................................... 100.0% 100.0% 100%

Threshold ................................. 95.0% 96.5% 50%

Below Threshold ........................... <95.0% < 96.5% 0%

44