CenturyLink 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

retirement after age 55. For additional information on early retirement benefits, please see the applicable early

retirement provisions of the Pension Plans, copies of which are filed with the SEC.

Glen F. Post, III, R. Stewart Ewing, Jr. and David D. Cole are currently eligible for early retirement under

the Qualified Plan and Supplemental Plan.

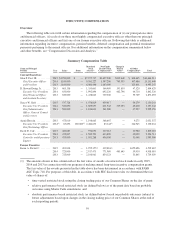

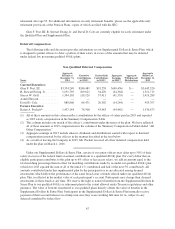

Deferred Compensation

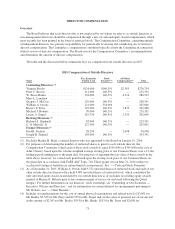

The following table and discussion provides information on our Supplemental Dollars & Sense Plan, which

is designed to permit officers to defer a portion of their salary in excess of the amounts that may be deferred

under federal law governing qualified 401(k) plans.

Non-Qualified Deferred Compensation

Name

Aggregate

Balance at

December 31,

2014

Executive

Contributions

in 2015(1)

CenturyLink

Contributions

in 2015(2)

Aggregate

Earnings

in 2015(3)

Aggregate

Withdrawals/

Distributions

Aggregate

Balance at

December 31,

2015

Current Executives:

Glen F. Post, III ............ $3,354,249 $240,489 $91,238 $(40,456) $— $3,645,520

R. Stewart Ewing, Jr. ........ 1,191,795 109,811 34,470 (24,364) — 1,311,713

Stacey W. Goff ............ 1,304,101 119,129 37,411 (41,353) — 1,419,289

Aamir Hussain ............. — — — — — —

David D. Cole ............. 880,868 66,471 20,302 (14,244) — 953,397

Former Executive:

Karen A. Puckett(4) ......... 1,457,144 74,508 43,463 (44,442) — 1,530,673

(1) All of these amounts in this column reflect contributions by the officer of salary paid in 2015 and reported

as 2015 salary compensation in the Summary Compensation Table.

(2) This column includes our match of the officer’s contribution under the terms of the plan. We have reflected

all of these amounts as 2015 compensation in the column of the Summary Compensation Table labeled “All

Other Compensation.”

(3) Aggregate earnings in 2015 include interest, dividends and distributions earned with respect to deferred

compensation invested by the officers in the manner described in the text below.

(4) As a result of leaving the Company in 2015, Ms. Puckett received all of her deferred compensation held

under the plan on March 1, 2016.

Under our Supplemental Dollars & Sense Plan, certain of our senior officers may defer up to 50% of their

salary in excess of the federal limit on annual contributions to a qualified 401(k) plan. For every dollar that an

eligible participant contributes to this plan up to 6% of his or her excess salary, we add an amount equal to the

total matching percentage then in effect for matching contributions made by us under our qualified 401(k) plan

(which for 2015 equaled the sum of all of the initial 1% contributed and half of the next 5% contributed). All

amounts contributed under this supplemental plan by the participants or us are allocated among deemed

investments which follow the performance of the same broad array of funds offered under our qualified 401(k)

plan. This is reflected in the market value of each participant’s account. Participants may change their deemed

investments in these funds at any time. We reserve the right to transfer benefits from the Supplemental Dollars &

Sense Plan to our qualified 401(k) or retirement plans to the extent allowed under Treasury regulations and other

guidance. The value of benefits transferred to our qualified plans directly offsets the value of benefits in the

Supplemental Dollars & Sense Plan. Participants in the Supplemental Dollars & Sense Plan normally receive

payment of their account balances in a lump sum once they cease working full-time for us, subject to any

deferrals mandated by federal law.

67