CenturyLink 2015 Annual Report Download - page 153

Download and view the complete annual report

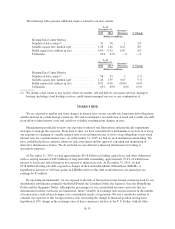

Please find page 153 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Additionally, during the third quarter of 2014, we developed a plan to migrate customers from one of our

networks to another over a one-year period beginning in the fourth quarter of 2014. As a result, we implemented

changes in estimates that reduced the remaining economic lives of certain network assets. The increase in

depreciation expense from the changes in estimates was more than fully offset by decreases in depreciation

expense resulting from normal aging of our property, plant and equipment. These changes in the estimated

remaining economic lives resulted in an increase in depreciation expense of approximately $48 million and $12

million for the years ended December 31, 2015 and 2014, respectively. This increase in depreciation expense, net

of tax, reduced consolidated net income by approximately $32 million, or $0.06 per basic and diluted common

share and $7 million, or $0.01 per basic and diluted common share, for the years ended December 31, 2015 and

2014, respectively.

Summary of Significant Accounting Policies

Use of Estimates

Our consolidated financial statements are prepared in accordance with U.S. generally accepted accounting

principles. These accounting principles require us to make certain estimates, judgments and assumptions. We

believe that the estimates, judgments and assumptions we make when accounting for specific items and matters,

including, but not limited to, investments, long-term contracts, customer retention patterns, allowance for

doubtful accounts, depreciation, amortization, asset valuations, internal labor capitalization rates, recoverability

of assets (including deferred tax assets), impairment assessments, pension, post-retirement and other post-

employment benefits, taxes, certain liabilities and other provisions and contingencies, are reasonable, based on

information available at the time they are made. These estimates, judgments and assumptions can materially

affect the reported amounts of assets, liabilities and components of stockholders’ equity as of the dates of the

consolidated balance sheets, as well as the reported amounts of revenues, expenses and components of cash flows

during the periods presented in our other consolidated financial statements. We also make estimates in our

assessments of potential losses in relation to threatened or pending tax and legal matters. See Note 11—Income

Taxes and Note 14—Commitments and Contingencies for additional information.

For matters not related to income taxes, if a loss is considered probable and the amount can be reasonably

estimated, we recognize an expense for the estimated loss. If we have the potential to recover a portion of the

estimated loss from a third party, we make a separate assessment of recoverability and reduce the estimated loss

if recovery is also deemed probable.

For matters related to income taxes, if we determine that the impact of an uncertain tax position is more

likely than not to be sustained upon audit by the relevant taxing authority, then we recognize a benefit for the

largest amount that is more likely than not to be sustained. No portion of an uncertain tax position will be

recognized if the position has less than a 50% likelihood of being sustained. Interest is recognized on the amount

of unrecognized benefit from uncertain tax positions.

For all of these and other matters, actual results could differ materially from our estimates.

Revenue Recognition

We recognize revenue for services when the related services are provided. Recognition of certain payments

received in advance of services being provided is deferred until the service is provided. These advance payments

include activation and installation charges, which we recognize as revenue over the expected customer

relationship period, which ranges from eighteen months to over ten years depending on the service. We also defer

costs for customer activations and installations. The deferral of customer activation and installation costs is

limited to the amount of revenue deferred on advance payments. Costs in excess of advance payments are

recorded as expense in the period such costs are incurred. Expected customer relationship periods are estimated

using historical experience. In most cases, termination fees or other fees on existing contracts that are negotiated

in conjunction with new contracts are deferred and recognized over the new contract term.

B-45