CenturyLink 2015 Annual Report Download - page 178

Download and view the complete annual report

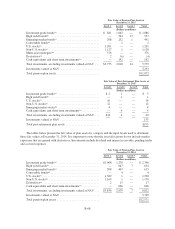

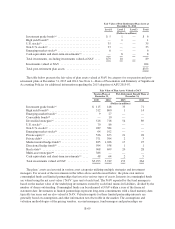

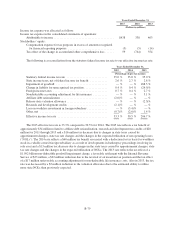

Please find page 178 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.monitored and evaluated for reasonableness. Below is an overview of the asset categories, the underlying

strategies and valuation inputs used to value the assets in the preceding tables:

(a) Investment grade bonds represent investments in fixed income securities as well as commingled

bond funds comprised of U.S. Treasury securities, agencies, corporate bonds, mortgage-backed securities, asset-

backed securities and commercial mortgage-backed securities. Treasury securities are valued at the bid price

reported in the active market in which the security is traded and are classified as Level 1. The valuation inputs of

other investment grade bonds primarily utilize observable market information and are based on a spread to U.S.

Treasury securities and consider yields available on comparable securities of issuers with similar credit ratings.

The primary observable inputs include references to the new issue market for similar securities, the secondary

trading markets and dealer quotes. Option adjusted spread models are utilized to evaluate securities such as asset

backed securities that have early redemption features. These securities are classified as Level 2. The commingled

funds are valued at NAV based on the market value of the underlying fixed income securities using the same

valuation inputs described above.

(b) High yield bonds represent investments in below investment grade fixed income securities as well

as commingled high yield bond funds. The valuation inputs for the securities primarily utilize observable market

information and are based on a spread to U.S. Treasury securities and consider yields available on comparable

securities of issuers with similar credit ratings. These securities are primarily classified as Level 2. The

commingled funds are valued at NAV based on the market value of the underlying high yield instruments using

the same valuation inputs described above.

(c) Emerging market bonds represent investments in securities issued by governments and other entities

located in developing countries as well as registered mutual funds and commingled emerging market bond funds.

The valuation inputs for the securities utilize observable market information and are primarily based on dealer

quotes or a spread relative to the local government bonds. The registered mutual fund is classified as Level 1

while individual securities are classified as Level 2. The commingled funds are valued at NAV based on the

market value of the underlying emerging market bonds using the same valuation inputs described above.

(d) Convertible bonds primarily represent investments in corporate debt securities that have features

that allow the debt to be converted into equity securities under certain circumstances. The valuation inputs for the

individual convertible bonds primarily utilize observable market information including a spread to U.S.

Treasuries and the value and volatility of the underlying equity security. Convertible bonds are classified as

Level 2.

(e) Diversified strategies represent an investment in a commingled fund that primarily has exposures to

global government, corporate and inflation linked bonds, global stocks and commodities. The commingled fund

is valued at NAV based on the market value of the underlying investments. The valuation inputs utilize

observable market information including published prices for exchange traded securities, bid prices for

government bonds, and spreads and yields available for comparable fixed income securities with similar credit

ratings.

(f) U.S. stocks represent investments in stocks of U.S. based companies as well as commingled U.S.

stock funds. The valuation inputs for U.S. stocks are based on the last published price reported on the major stock

market on which the securities are traded and are classified as Level 1. The commingled funds are valued at

NAV based on the market value of the underlying investments using the same valuation inputs described above.

(g) Non-U.S. stocks represent investments in stocks of companies based in developed countries outside

the U.S. as well as commingled funds. The valuation inputs for non-U.S. stocks are based on the last published

price reported on the major stock market on which the securities are traded and are primarily classified as

Level 1. The commingled funds are valued at NAV based on the market value of the underlying investments

using the same valuation inputs described above.

B-70