CenturyLink 2015 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interbank Offered Rate and consider yields available on comparable securities of issuers with similar credit

ratings and are classified as Level 2. The commingled funds are valued at NAV based on the market value of the

underlying investments using the same valuation inputs described above.

Concentrations of Risk: Investments, in general, are exposed to various risks, such as significant world

events, interest rate, credit, foreign currency and overall market volatility risk. These risks are managed by

broadly diversifying assets across numerous asset classes and strategies with differing expected returns,

volatilities and correlations. Risk is also broadly diversified across numerous market sectors and individual

companies. Financial instruments that potentially subject the plans to concentrations of counterparty risk consist

principally of investment contracts with high quality financial institutions. These investment contracts are

typically collateralized obligations and/or are actively managed, limiting the amount of counterparty exposure to

any one financial institution. Although the investments are well diversified, the value of plan assets could change

materially depending upon the overall market volatility, which could affect the funded status of the plans.

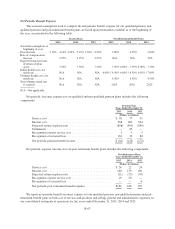

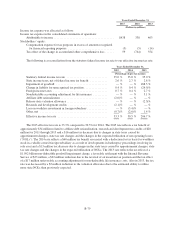

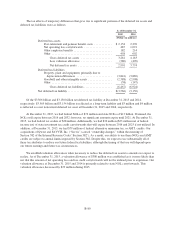

The table below presents a rollforward of the pension plan assets valued using Level 3 inputs:

Pension Plan Assets Valued

Using Level 3 Inputs

High

Yield

Bonds

Emerging

Market

Bonds Total

(Dollars in millions)

Balance at December 31, 2013 .......................... $— — —

Net transfers ......................................... 6 — 6

Acquisitions ......................................... 1 — 1

Dispositions ......................................... (3) — (3)

Actual return on plan assets:

Gains relating to assets sold during the year ............ 4 — 4

(Losses) gains relating to assets still held at year-end ..... (1) — (1)

Balance at December 31, 2014 .......................... 7 — 7

Net transfers ......................................... 4 1 5

Acquisitions ......................................... 4 — 4

Dispositions ......................................... (2) — (2)

Actual return on plan assets:

Gains relating to assets sold during the year ............ — — —

(Losses) gains relating to assets still held at year-end ..... — — —

Balance at December 31, 2015 .......................... $13 1 14

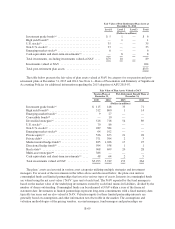

Certain gains and losses are allocated between assets sold during the year and assets still held at year-end

based on transactions and changes in valuations that occurred during the year. These allocations also impact our

calculation of net acquisitions and dispositions.

For the year ended December 31, 2015, the investment program produced actual losses on qualified pension

and post-retirement plan assets of $158 million as compared to expected returns of $919 million for a difference

of $1.077 billion. For the year ended December 31, 2014, the investment program produced actual gains on

pension and post-retirement plan assets of $1.410 billion as compared to the expected returns of $924 million for

a difference of $486 million. The short-term annual returns on plan assets will almost always be different from

the expected long-term returns and the plans could experience net gains or losses, due primarily to the volatility

occurring in the financial markets during any given year.

B-72