CenturyLink 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

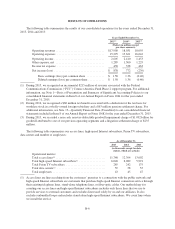

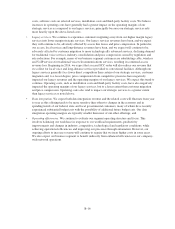

The following table reconciles our total segment revenues and total segment income presented above to

consolidated operating revenues and consolidated operating income reported in our consolidated statements of

operations.

Years Ended December 31,

2015 2014 2013

(Dollars in millions)

Total segment revenues ................................................ $16,668 17,028 17,095

Other operating revenues ............................................... 1,232 1,003 1,000

Operating revenues reported in our consolidated statements of operations ......... $17,900 18,031 18,095

Total segment income ................................................. $ 8,209 8,519 8,928

Other operating revenues ............................................... 1,232 1,003 1,000

Depreciation and amortization ........................................... (4,189) (4,428) (4,541)

Impairment of goodwill (Note 2) ......................................... — — (1,092)

Other unassigned operating expenses ..................................... (2,647) (2,684) (2,842)

Operating income reported in our consolidated statement of operations ........... $ 2,605 2,410 1,453

Allocation of Revenues and Expenses

Our segment revenues include all revenues from our strategic services, legacy services and data integration

as described in more detail above. Segment revenues are based upon each customer’s classification to an

individual segment. We report our segment revenues based upon all services provided to that segment’s

customers. For information on how we allocate expenses to our segments, as well as other additional information

about our segments, see Note 12—Segment Information to our consolidated financial statements in Item 8 of our

Annual Report on Form 10-K for the year ended December 31, 2015.

Business Segment

The operations of our business segment have been impacted by several significant trends, including those

described below:

•Strategic services. Our mix of total business segment revenues continues to migrate from legacy

services to strategic services as our small, medium and enterprise business, wholesale and

governmental customers increasingly demand integrated data, Internet, hosting and voice services.

During 2015, our strategic revenues were negatively impacted by several factors, including competitive

pressures, customer losses, migration from traditional hosting services to lower priced cloud-based

services and transitioning to our new management structure negatively impacted the growth of our

strategic revenues. Demand for our private line services (including special access) continues to decline

due to our customers’ optimization of their networks, industry consolidation and technological

migration to higher-speed services. Additionally, we face competition in Ethernet based services in the

wholesale market from cable companies and fiber based CLEC providers. We anticipate continued

pricing pressure for our colocation services as vendors continue to expand their enterprise colocation

operations. In recent years, our competitors, as well as several large, diversified technology companies,

have made substantial investments in cloud computing, which has intensified competitive pressures.

This expansion in competitive cloud computing offerings has led to increased pricing pressure and

competition for enterprise customers, and we expect these trends to continue. The demand for new

technology has also increased the number of competitors offering strategic services similar to ours.

Price compression from each of these above-mentioned competitive pressures has negatively impacted

the operating margins of our strategic services and we expect this trend to continue. Operating costs

also impact the operating margins of our strategic services, but to a lesser extent than price

compression and customer disconnects. These operating costs include sales commissions, modem

B-15