CenturyLink 2015 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

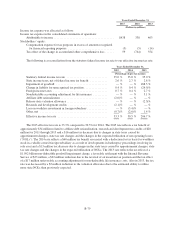

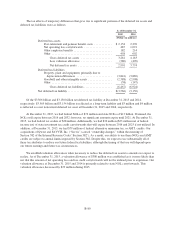

The tax effects of temporary differences that gave rise to significant portions of the deferred tax assets and

deferred tax liabilities were as follows:

As of December 31,

2015 2014

(Dollars in millions)

Deferred tax assets

Post-retirement and pension benefit costs ............ $2,154 2,276

Net operating loss carryforwards ................... 487 1,091

Other employee benefits .......................... 182 214

Other ......................................... 458 602

Gross deferred tax assets ..................... 3,281 4,183

Less valuation allowance ..................... (380) (409)

Net deferred tax assets ....................... 2,901 3,774

Deferred tax liabilities

Property, plant and equipment, primarily due to

depreciation differences ........................ (3,841) (3,869)

Goodwill and other intangible assets ................ (2,588) (2,908)

Other ......................................... (38) (147)

Gross deferred tax liabilities ................... (6,467) (6,924)

Net deferred tax liability .............................. $(3,566) (3,150)

Of the $3.566 billion and $3.150 billion net deferred tax liability at December 31, 2015 and 2014,

respectively, $3.569 billion and $3.154 billion is reflected as a long-term liability and $3 million and $4 million

is reflected as a net noncurrent deferred tax asset at December 31, 2015 and 2014, respectively.

At December 31, 2015, we had federal NOLs of $72 million and state NOLs of $13 billion. If unused, the

NOLs will expire between 2016 and 2032; however, no significant amounts expire until 2021. At December 31,

2015, we had federal tax credits of $28 million. Additionally, we had $36 million ($23 million net of federal

income tax) of state investment tax credit carryforwards that will expire between 2016 and 2025 if not utilized. In

addition, at December 31, 2015, we had $79 million of federal alternative minimum tax, or AMT, credits. Our

acquisitions of Qwest and SAVVIS, Inc. (“Savvis”) caused “ownership changes” within the meaning of

Section 382 of the Internal Revenue Code (“Section 382”). As a result, our ability to use these NOLs and AMT

credits are subject to annual limits imposed by Section 382. Despite this, we expect to use substantially all of

these tax attributes to reduce our future federal tax liabilities, although the timing of that use will depend upon

our future earnings and future tax circumstances.

We establish valuation allowances when necessary to reduce the deferred tax assets to amounts we expect to

realize. As of December 31, 2015, a valuation allowance of $380 million was established as it is more likely than

not that this amount of net operating loss and tax credit carryforwards will not be utilized prior to expiration. Our

valuation allowance at December 31, 2015 and 2014 is primarily related to state NOL carryforwards. This

valuation allowance decreased by $29 million during 2015.

B-80