CenturyLink 2015 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.climate; and (vii) recognition of a goodwill impairment loss in the financial statements of one or more of our

subsidiaries that are a component of our segments. We will continue to monitor certain events that impact our

operations to determine if an interim assessment of goodwill impairment should be performed prior to the next

required assessment date of October 31, 2016.

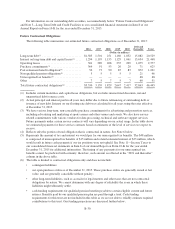

Property, Plant and Equipment

Property, plant and equipment acquired in connection with our acquisitions was recorded based on its

estimated fair value as of its acquisition date, plus the estimated value of any associated legally or contractually

required asset retirement obligation. Purchased and constructed property, plant and equipment is recorded at cost,

plus the estimated value of any associated legally or contractually required asset retirement obligation. Renewals

and betterments of plant and equipment are capitalized while repairs, as well as renewals of minor items, are

charged to operating expense. Depreciation of property, plant and equipment is provided on the straight-line

method using class or overall group rates. The group method provides for the recognition of the remaining net

investment, less anticipated net salvage value, over the remaining useful life of the assets. This method requires

the periodic revision of depreciation rates.

Normal retirements of property, plant and equipment are charged against accumulated depreciation, with no

gain or loss recognized. We depreciate such property on the straight-line method over estimated service lives

ranging from 3 to 45 years.

We perform annual internal reviews to evaluate the reasonableness of the depreciable lives for our property,

plant and equipment. Our reviews utilize models that take into account actual usage, physical wear and tear,

replacement history, assumptions about technology evolution and, in certain instances, actuarially determined

probabilities to estimate the remaining life of our asset base.

Due to rapid changes in technology and the competitive environment, determining the estimated economic

life of telecommunications plant, equipment and software requires a significant amount of judgment. We

regularly review data on utilization of equipment, asset retirements and salvage values to determine adjustments

to our depreciation rates. The effect of a hypothetical one year increase or decrease in the estimated remaining

useful lives of our property, plant and equipment would have decreased depreciation expense by approximately

$410 million annually or increased depreciation expense by approximately $580 million annually, respectively.

Pension and Post-retirement Benefits

We sponsor a noncontributory qualified defined benefit pension plan (referred to as our pension plan) for a

substantial portion of our employees. In addition to this tax qualified pension plan, we also maintain several non-

qualified pension plans for certain eligible highly compensated employees. We also maintain post-retirement

benefit plans that provide health care and life insurance benefits for certain eligible retirees.

In 2015, approximately 45% of the qualified pension plan’s January 1, 2015 net actuarial loss balance of

$2.740 billion was subject to amortization as a component of net periodic expense over the average remaining

service period of participating employees expected to receive benefits, which ranges from 8 to 9 years for the

plan. The other 55% of the qualified pension plan’s beginning net actuarial loss balance was treated as

indefinitely deferred during 2015. The entire beginning net actuarial loss of $277 million for the post-retirement

benefit plans was treated as indefinitely deferred during 2015.

In 2014, approximately 16% of the qualified pension plans’ January 1, 2014 net actuarial loss balance of

$1.048 billion was subject to amortization as a component of net periodic expense over the average remaining

service period of participating employees expected to receive benefits, which ranges from 8 to 9 years for the

plans. The other 84% of the pension plan’s beginning net actuarial loss balance was treated as indefinitely

deferred during 2014. The entire beginning net actuarial loss of $37 million for the post-retirement benefit plans

was treated as indefinitely deferred during 2014.

B-23