CenturyLink 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Recent Actions. In connection with establishing 2016 annual incentive bonus targets, the Committee made

no changes to our named executive officers’ bonus target percentages; however, the amount of Mr. Hussain’s

bonus target incrementally increased in proportion with his base salary increase.

Non-Executive Bonuses. We currently offer STI bonuses to all of our non-union and non-sales employees

and the STI thresholds, targets and maximum financial performance targets for our non-senior officers are the

same as the Committee approves for our senior officers. As discussed below under the heading “— Our

Compensation Decision-Making Process,” the CEO approves the performance goals of substantially all of the

non-senior officers under the general supervision of the Compensation Committee.

Long-Term Equity Incentive Compensation

General. Our shareholder-approved long-term incentive compensation programs authorize the

Compensation Committee to grant a variety of stock-based incentive awards to key personnel. We believe stock

incentive awards (i) encourage key personnel to focus on sustainable long-term performance, (ii) strengthen the

relationship between compensation and growth in the market price of the company’s common shares and thereby

align management’s financial interests with those of the shareholders and (iii) help attract and retain talented

personnel.

As it did in 2014, the Compensation Committee in 2015 granted 60% of our senior officers’ target equity

incentive compensation in the form of performance-based restricted stock, which is ultimately payable only if we

attain certain specified goals. The remaining portion of our senior officers’ long-term equity incentive

compensation awarded in 2014 and 2015 was paid in time-vested restricted stock, the value of which is

dependent on our performance over an extended vesting period.

In February 2016, we granted long-term equity incentive compensation awards to approximately 2% of our

non-executive employees in the form of time-vested restricted shares.

Performance Benchmarks. On an annual basis, the Committee reviews the relevance of our performance

benchmarks for alignment with our long-term strategic plan. In 2015, we kept the same two performance

benchmarks, relative TSR and absolute revenue, that we used for our 2014 performance-based restricted shares.

See further discussion under the heading “— Overview of Pay Elements and Linkage to Compensation

Philosophy and Objectives” in Subsection II above.

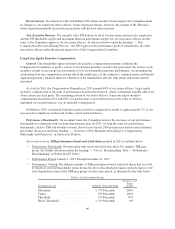

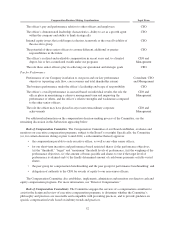

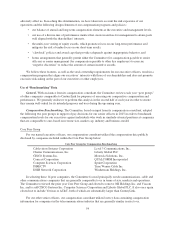

An overview of our TSR performance-based restricted shares granted in 2015 is outlined below.

• Performance Benchmark: Our percentile rank versus the below-described 26-company TSR peer

group. See further discussion under the heading “— Use of ‘Benchmarking’ Data — Performance

Benchmarking” in Subsection IV below.

•Performance Period: January 1, 2015 through December 31, 2017

• Performance Vesting: The ultimate number of TSR performance-based restricted shares that vest will

be based on our total shareholder return during the above-described performance period relative to the

total shareholder return of the TSR peer group over the same period, as illustrated in the table below.

Relative Total Shareholder Return

Performance Level Company’s Percentile Rank

Payout as % of

Target

Award(1)

Maximum ......................... ≥75th Percentile 200%

Target ............................ 50

th Percentile 100%

Threshold ......................... 25

th Percentile 50%

Below Threshold ................... <25

th Percentile 0%

46