CenturyLink 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Dividends

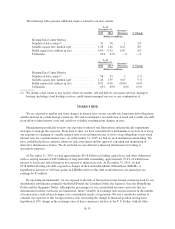

We currently expect to continue our current practice of paying quarterly cash dividends in respect of our

common stock subject to our Board of Directors’ discretion to modify or terminate this practice at any time and

for any reason without prior notice. Our current quarterly common stock dividend rate is $0.54 per share, as

approved by our Board of Directors, which we believe is a dividend rate per share that gives us the flexibility to

balance our multiple objectives of managing our business, paying our fixed commitments and returning cash to

our shareholders. Assuming continued payment during 2016 at this rate of $0.54 per share, our total dividends

paid each quarter would be approximately $292 million based on our current number of outstanding shares

(which does not reflect shares that we might repurchase or issue in future periods). See “Risk Factors—Risks

Affecting Our Business” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2015.

Credit Facility

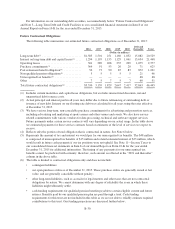

Our $2.0 billion Credit Facility matures on December 3, 2019 and has 16 lenders, each with commitments

ranging from $3.5 million to $198.5 million. The Credit Facility allows us to obtain revolving loans and to issue

up to $400 million of letters of credit, which upon issuance reduce the amount available for other extensions of

credit. Interest is assessed on borrowings using either the LIBOR or the base rate (each as defined in the Credit

Facility) plus an applicable margin between 1.00% and 2.25% per annum for LIBOR loans and 0.00% and

1.25% per annum for base rate loans depending on our then current senior unsecured long-term debt rating. Our

obligations under the Credit Facility are guaranteed by nine of our subsidiaries. At December 31, 2015, we had

$330 million in borrowings and no amounts of letters of credit outstanding under the Credit Facility.

Under the Credit Facility, we, and our indirect subsidiary, Qwest Corporation, must maintain a debt to

EBITDA (earnings before interest, taxes, depreciation and amortization, as defined in our Credit Facility) ratio of

not more than 4.0:1.0 and 2.85:1.0, respectively, as of the last day of each fiscal quarter for the four quarters then

ended. The Credit Facility also contains a negative pledge covenant, which generally requires us to secure

equally and ratably any advances under the Credit Facility if we pledge assets or permit liens on our property for

the benefit of other debtholders. The Credit Facility also has a cross payment default provision, and the Credit

Facility and certain of our debt securities also have cross acceleration provisions. When present, these provisions

could have a wider impact on liquidity than might otherwise arise from a default or acceleration of a single debt

instrument. Our debt to EBITDA ratios could be adversely affected by a wide variety of events, including

unforeseen expenses or contingencies. This could reduce our financing flexibility due to potential restrictions on

incurring additional debt under certain provisions of our debt agreements or, in certain circumstances, could

result in a default under certain provisions of such agreements.

Term Loans, Revolving Line of Credit and Revolving Letter of Credit

At December 31, 2015, CenturyLink, Inc. owed $358 million under a term loan maturing in 2019 and Qwest

Corporation owed $100 million under a term loan maturing in 2025. Both of these term loans include covenants

substantially similar to those set forth in the Credit Facility.

In January 2015, CenturyLink, Inc. entered into a $100 million uncommitted revolving line of credit with

one of the lenders under the Credit Facility. The amount available under this uncommitted revolving line of

credit is reduced by any amount outstanding under the Credit Facility with the same lender. Interest is paid

monthly based upon the LIBOR plus an applicable margin between 1.00% and 2.25% per annum. At

December 31, 2015, we had $80 million borrowings outstanding under this uncommitted revolving line of credit.

We have a $160 million uncommitted revolving letter of credit facility which enables us to provide letters of

credit under terms that may be more favorable than those under the Credit Facility. At December 31, 2015, our

outstanding letters of credit totaled $109 million under this facility.

B-29