CenturyLink 2015 Annual Report Download - page 173

Download and view the complete annual report

Please find page 173 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

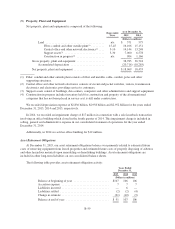

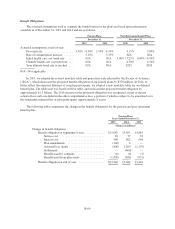

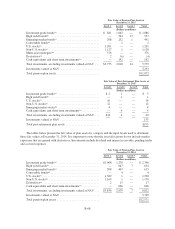

Post-Retirement Benefit Plans

Years Ended December 31,

2015 2014 2013

(Dollars in millions)

Change in benefit obligation

Benefit obligation at beginning of year ............... $3,830 3,688 4,075

Service cost ................................. 24 22 24

Interest cost ................................. 140 159 140

Participant contributions ....................... 57 69 96

Plan amendments ............................ — 23 141

Direct subsidy receipts ........................ 8 9 13

Actuarial loss (gain) .......................... (148) 245 (399)

Benefits paid by company ...................... (181) (166) (266)

Benefits paid from plan assets .................. (163) (219) (136)

Benefit obligation at end of year ..................... $3,567 3,830 3,688

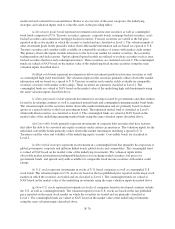

Our aggregate benefit obligation as of December 31, 2015, 2014 and 2013 was $16.916 billion, $18.872

billion and $17.089 billion, respectively.

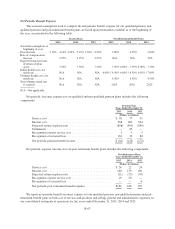

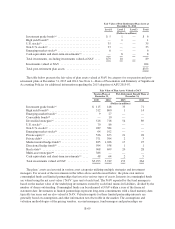

Plan Assets

We maintain plan assets for our qualified pension plan and certain post-retirement benefit plans. The

qualified pension plan’s assets are used for the payment of pension benefits and certain eligible plan expenses.

The post-retirement benefit plan’s assets are used to pay health care benefits and premiums on behalf of eligible

retirees and to pay certain eligible plan expenses. The expected rate of return on plan assets is the long-term rate

of return we expect to earn on the plans’ assets, net of administrative expenses paid from plan assets. The rate of

return is determined by the strategic allocation of plan assets and the long-term risk and return forecast for each

asset class. The forecasts for each asset class are generated primarily from an analysis of the long-term

expectations of various third party investment management organizations. The expected rate of return on plan

assets is reviewed annually and revised, as necessary, to reflect changes in the financial markets and our

investment strategy.

The following tables summarize the change in the fair value of plan assets for the pension and post-

retirement benefit plans:

Pension Plans

Years Ended December 31,

2015 2014 2013

(Dollars in millions)

Change in plan assets

Fair value of plan assets at beginning of year ........ $12,571 12,346 12,321

Return on plan assets ........................... (161) 1,373 810

Employer contributions ......................... 100 157 146

Settlements ................................... — (460) —

Benefits paid from plan assets .................... (1,438) (845) (931)

Fair value of plan assets at end of year ................. $11,072 12,571 12,346

B-65