CenturyLink 2015 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

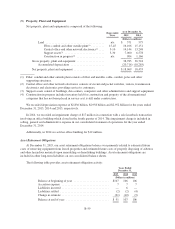

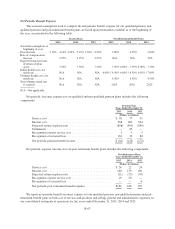

(3) Long-Term Debt and Credit Facilities

Long-term debt, including unamortized discounts and premiums and unamortized debt issuance costs,

consisted of borrowings by CenturyLink, Inc. and certain of its subsidiaries, including Qwest Corporation, Qwest

Capital Funding, Inc. and Embarq Corporation and subsidiaries (“Embarq”), were as follows:

As of December 31,

Interest Rates Maturities 2015 2014

(Dollars in millions)

CenturyLink, Inc.

Senior notes ................................. 5.150% - 7.650% 2017 - 2042 $ 7,975 7,825

Credit facility and revolving line of credit(1) ........ 2.010% - 4.250% 2019 410 725

Term loan ................................... 2.180% 2019 358 380

Subsidiaries

Qwest Corporation

Senior notes ............................. 6.125% - 8.375% 2016 - 2055 7,229 7,311

Term loan ............................... 2.180% 2025 100 —

Qwest Capital Funding, Inc. ....................

Senior notes ............................. 6.500% - 7.750% 2018 - 2031 981 981

Embarq Corporation and subsidiaries .............

Senior notes ............................. 7.082% - 7.995% 2016 - 2036 2,669 2,669

First mortgage bonds ...................... 7.125% - 8.770% 2017 - 2025 232 232

Other .................................. 9.000% 2019 150 150

Capital lease and other obligations ................... Various Various 425 509

Unamortized discounts, net ......................... (125) (111)

Unamortized debt issuance costs ..................... (179) (168)

Total long-term debt .............................. 20,225 20,503

Less current maturities ............................. (1,503) (550)

Long-term debt, excluding current maturities ........... $18,722 19,953

(1) The aggregate amount outstanding on our Credit Facility and revolving line of credit borrowings at

December 31, 2015 and 2014 was $410 million and $725 million, respectively, with weighted average

interest rates of 2.756% and 2.270%, respectively. These amounts change on a regular basis.

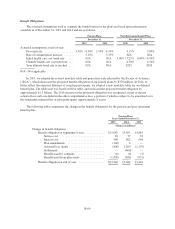

New Issuances

2015

On September 21, 2015, Qwest Corporation issued $400 million aggregate principal amount of 6.625%

Notes due 2055, in exchange for net proceeds, after deducting underwriting discounts and other expenses, of

approximately $386 million. The underwriting agreement included an over-allotment option granting the

underwriters for the offering an opportunity to purchase additional 6.625% Notes due 2055. On September 30,

2015, Qwest Corporation issued an additional $10 million aggregate principal amount of the 6.625% Notes under

this over-allotment option. All of the 6.625% Notes are unsecured obligations and may be redeemed by Qwest

Corporation, in whole or in part, on or after September 15, 2020, at a redemption price equal to 100% of the

principal amount redeemed plus accrued and unpaid interest to the redemption date.

On March 19, 2015, CenturyLink, Inc. issued in a private offering $500 million aggregate principal amount

of 5.625% Notes due 2025, in exchange for net proceeds, after deducting underwriting discounts and other

expenses, of approximately $494 million. The Notes are senior unsecured obligations and may be redeemed, in

whole or in part, at any time before January 1, 2025 at a redemption price equal to the greater of 100% of the

principal amount of the Notes or the sum of the present value of the remaining scheduled payments of principal

B-54