CenturyLink 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

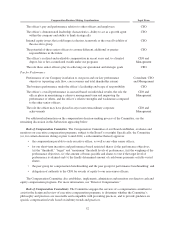

contrast, the peer group for performance benchmarking is comprised of companies we believe investors are

considering when they decide whether to invest in us or our industry.

TSR Peer Group for Performance Benchmarking

AT&T, Inc. JDS Uniphase Corporation

Cablevision Systems Corporation* Level 3 Communications, Inc.*

Ciena Corporation Liberty Global plc*

Cincinnati Bell Inc. Motorola Solutions, Inc.*

Cogent Communications Holdings, Inc. Rackspace Hosting, Inc.

Comcast Corporation* Sirius XM Holdings Inc.

Consolidated Communications Holdings Inc. Spok Holdings, Inc.

Crown Castle International Corp. Sprint Corporation*

Dish Network Corp.* Telephone & Data Systems Inc.

Finisar Corp. United States Cellular Corporation

Frontier Communications Corporation Verizon Communications Inc.

General Communication Inc. Viacom, Inc.

IDT Corporation Windstream Holdings, Inc.*

* Also included in the Committee’s above-listed Core Peer Group used for 2015 compensation benchmarking.

Forfeiture of Prior Compensation

For over 10 years, all recipients of our equity compensation grants have been required to contractually agree

to forfeit certain of their awards (and to return to us any cash, securities or other assets received by them upon the

sale of Common Shares they acquired through certain prior equity awards) if at any time during their

employment with us or within 18 months after termination of employment they engage in activity contrary or

harmful to our interests. The Compensation Committee is authorized to waive these forfeiture provisions if it

determines in its sole discretion that such action is in our best interests. We have filed with the SEC copies of our

form of equity incentive agreements containing these forfeiture provisions. Our 2016 Executive Officers Short-

Term Incentive Plan contains substantially similar forfeiture provisions.

Our Corporate Governance Guidelines authorize the Board to recover, or “clawback,” compensation from

an executive officer if the Board determines that any bonus, incentive payment, equity award or other

compensation received by the executive was based on any financial or operating result that was impacted by the

executive’s knowing or intentional fraudulent or illegal conduct. Certain provisions of the Sarbanes-Oxley Act of

2002 would require our CEO and CFO to reimburse us for incentive compensation paid or trading profits earned

following the release of financial statements that are subsequently restated due to material noncompliance with

SEC reporting requirements caused by misconduct. In addition, provisions of the Dodd-Frank Wall Street

Reform and Consumer Protection Act of 2010 will, upon the completion of related rulemaking, require all of our

current or former executive officers to make similar reimbursement payments in connection with certain financial

statement restatements, irrespective of whether such executives were involved with the mistake that caused the

restatement.

56