CenturyLink 2015 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Derivative instruments: Derivative instruments are used to reduce risk as well as provide return. The

pension and post-retirement benefit plans use exchange traded futures and swaps to gain exposure to equity and

interest rate markets consistent with target asset allocations and to reduce risk relative to measurement of the

benefit obligation, which is sensitive to interest rate changes. Foreign exchange forward contracts are used to

manage currency exposures. Credit default swaps are used to manage credit risk exposures in a cost effective and

targeted manner relative to transacting with physical corporate fixed income securities. Options are currently

used to manage interest rate exposure taking into account the implied volatility and current pricing of the specific

underlying market instrument. Some derivative instruments subject the plans to counterparty risk. The external

investment managers, along with Plan Management, monitor counterparty exposure and mitigate this risk by

diversifying the exposure among multiple high credit quality counterparties, requiring collateral and limiting

exposure by periodically settling contracts.

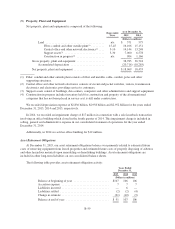

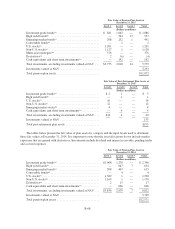

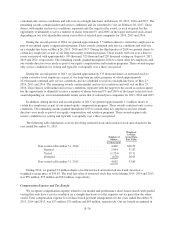

The gross notional exposure of the derivative instruments directly held by the plans is shown below. The

notional amount of the derivatives corresponds to market exposure but does not represent an actual cash

investment.

Gross Notional Exposure

Pension Plans

Post-Retirement

Benefit Plans

Years Ended December 31,

2015 2014 2015 2014

(Dollars in millions)

Derivative instruments:

Exchange-traded U.S. equity futures ....................... $ 79 134 — 7

Exchange-traded Treasury and other interest rate futures ....... 1,767 2,451 — —

Interest rate swaps ...................................... 550 579 — —

Credit default swaps .................................... 189 382 — —

Foreign exchange forwards ............................... 992 1,195 — 13

Options .............................................. 285 529 — —

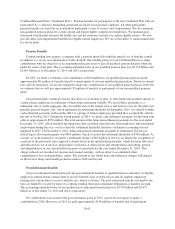

Fair Value Measurements: Fair value is defined as the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between independent and knowledgeable parties who are willing and

able to transact for an asset or liability at the measurement date. We use valuation techniques that maximize the

use of observable inputs and minimize the use of unobservable inputs when determining fair value and then we

rank the estimated values based on the reliability of the inputs used following the fair value hierarchy set forth by

the FASB. For additional information on the fair value hierarchy, see Note 10—Fair Value Disclosure.

At December 31, 2015, we used the following valuation techniques to measure fair value for assets. There

were no changes to these methodologies during 2015:

• Level 1—Assets were valued using the closing price reported in the active market in which the

individual security was traded.

• Level 2—Assets were valued using quoted prices in markets that are not active, broker dealer

quotations, net asset value of shares held by the plans and other methods by which all significant inputs

were observable at the measurement date.

• Level 3—Assets were valued using unobservable inputs in which little or no market data exists as

reported by the respective institutions at the measurement date.

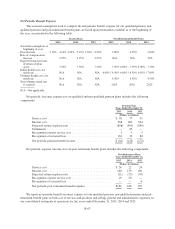

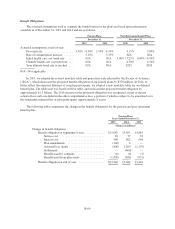

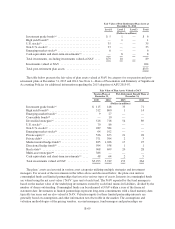

The tables below present the fair value of plan assets by category and the input levels used to determine

those fair values at December 31, 2015. It is important to note that the asset allocations do not include market

exposures that are gained with derivatives. Investments include dividend and interest receivables, pending trades

and accrued expenses.

B-67