CenturyLink 2015 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

parachute payment,” with respect to any employee, is the excess of the parachute payments to such person, in the

aggregate, over and above such person’s base amount. If the amounts received by an employee upon a change of

control are characterized as parachute payments, the employee will be subject to a 20% excise tax on the excess

parachute payment and we will be denied any deduction with respect to such excess parachute payment.

The foregoing discussion summarizes the federal income tax consequences of Incentives that may be

granted under the Plan based on current provisions of the Code, which are subject to change. This summary does

not cover any foreign, state, or local tax consequences.

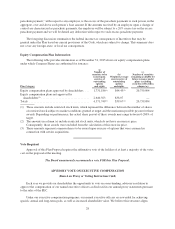

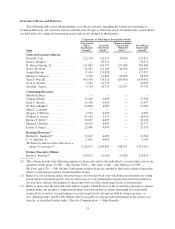

Equity Compensation Plan Information

The following table provides information as of December 31, 2015 about our equity compensation plans

under which Common Shares are authorized for issuance:

Plan Category

(a)

Number of

securities to be

issued upon

exercise of

outstanding

options

and rights

(b)

Weighted-average

exercise price of

outstanding

options

and rights

(c)

Number of securities

remaining available for

future issuance under

plans (excluding

securities reflected in

column (a))

Equity compensation plans approved by shareholders . . . 1,731,186(1) $44.43(2) 20,759,094

Equity compensation plans not approved by

shareholders(3) ................................. 2,640,563 $38.07 —

Totals ......................................... 4,371,749(1) $39.67(2) 20,759,094

(1) These amounts include restricted stock units, which represent the difference between the number of shares

of restricted stock subject to market conditions granted at target and the maximum possible payout for these

awards. Depending on performance, the actual share payout of these awards may range between 0-200% of

target.

(2) The amounts in column (a) include restricted stock units, which do not have an exercise price.

Consequently, those awards were excluded from the calculation of this exercise price.

(3) These amounts represent common shares to be issued upon exercise of options that were assumed in

connection with certain acquisitions.

Vote Required

Approval of this Plan Proposal requires the affirmative vote of the holders of at least a majority of the votes

cast on the proposal at the meeting.

The Board unanimously recommends a vote FOR this Plan Proposal.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Item 4 on Proxy or Voting Instruction Card)

Each year we provide our shareholders the opportunity to vote on a non-binding, advisory resolution to

approve the compensation of our named executive officers as disclosed in our annual proxy statements pursuant

to the rules of the SEC.

Under our executive compensation programs, our named executive officers are rewarded for achieving

specific annual and long-term goals, as well as increased shareholder value. We believe this structure aligns

28