CenturyLink 2015 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

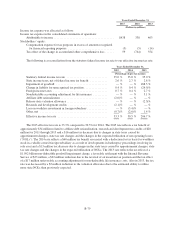

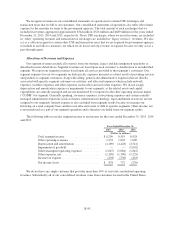

(13) Quarterly Financial Data (Unaudited)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

(Dollars in millions, except per share amounts)

2015

Operating revenues ..................................... $4,451 4,419 4,554 4,476 17,900

Operating income ...................................... 649 549 656 751 2,605

Net income ............................................ 192 143 205 338 878

Basic earnings per common share .......................... 0.34 0.26 0.37 0.62 1.58

Diluted earnings per common share ........................ 0.34 0.26 0.37 0.62 1.58

2014

Operating revenues ..................................... $4,538 4,541 4,514 4,438 18,031

Operating income ...................................... 653 655 619 483 2,410

Net income ............................................ 203 193 188 188 772

Basic earnings per common share .......................... 0.35 0.34 0.33 0.33 1.36

Diluted earnings per common share ........................ 0.35 0.34 0.33 0.33 1.36

During the third quarter of 2015, we recognized an incremental $158 million of revenue associated with the

FCC’s CAF Phase 2 support program, and an additional incremental $57 million in the fourth quarter of 2015.

During the fourth quarter of 2015, we also recognized a tax benefit of approximately $34 million related to

affiliate debt rationalization, research and development tax credits of $28 million for 2011 through 2015, and a

$16 million tax decrease due to changes in state taxes caused by apportionment changes, state tax rate changes

and the changes in the expected utilization of net operating losses (“NOLs”).

During the fourth quarter of 2014, we recognized a $60 million tax benefit associated with a deduction for

the tax basis for worthless stock in a wholly-owned foreign subsidiary as a result of developments in bankruptcy

proceedings involving its sole asset that occurred in the first quarter of 2014. During the fourth quarter of 2014,

we also recognized a pension settlement charge of $63 million.

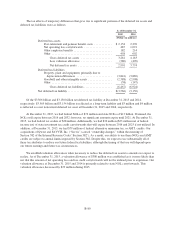

(14) Commitments and Contingencies

We are vigorously defending against all of the matters described below under the headings “Pending

Matters” and “Other Proceedings and Disputes.” As a matter of course, we are prepared both to litigate these

matters to judgment, as well as to evaluate and consider all reasonable settlement opportunities. In this Note,

when we refer to a class action as “putative” it is because a class has been alleged, but not certified in that matter.

We have established accrued liabilities for these matters described below where losses are deemed probable and

reasonably estimable.

Pending Matters

In William Douglas Fulghum, et al. v. Embarq Corporation, et al., filed on December 28, 2007 in the

United States District Court for the District of Kansas, a group of retirees filed a class action lawsuit challenging

the decision to make certain modifications in retiree benefits programs relating to life insurance, medical

insurance and prescription drug benefits, generally effective January 1, 2006 and January 1, 2008 (which, at the

time of the modifications, was expected to reduce estimated future expenses for the subject benefits by more than

$300 million). Defendants include Embarq, certain of its benefit plans, its Employee Benefits Committee and the

individual plan administrator of certain of its benefits plans. Additional defendants include Sprint Nextel and

certain of its benefit plans. The Court certified a class on certain of plaintiffs’ claims, but rejected class

certification as to other claims. On October 14, 2011, the Fulghum lawyers filed a new, related lawsuit, Abbott et

al. v. Sprint Nextel et al. In Abbott, approximately 1,500 plaintiffs allege breach of fiduciary duty in connection

with the changes in retiree benefits that also are at issue in the Fulghum case. The Abbott plaintiffs are all

members of the class that was certified in Fulghum on claims for allegedly vested benefits (Counts I and III), and

B-86