CenturyLink 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

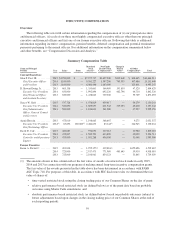

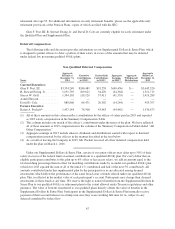

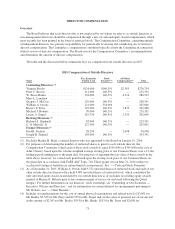

(1) Aamir Hussain is not currently eligible to participate in either of our Pension Plans.

(2) These figures represent accumulated benefits as of December 31, 2015 based on several assumptions,

including the assumption that the executive remains employed by us and begins receiving retirement

benefits at the normal retirement age of 65, with such accumulated benefits being discounted from the

normal retirement age to December 31, 2015 using discount rates ranging between 4.22% and 4.50%. No

adjustments have been made to reflect reductions required under any qualified domestic relations orders.

See Note 7 titled “Employee Benefits” of the notes to our audited financial statements included in

Appendix B for additional information.

(3) Karen Puckett received a lump sum payment under this plan on November 1, 2015 and is no longer entitled

to any future benefits under this plan.

Pension Plans. With limited exceptions specified in the Pension Plans, we “froze” our Qualified Plan and

Supplemental Plan as of December 31, 2010, which means that no additional monthly pension benefits have

accrued under such plans since that date (although service after that date continues to count towards vesting and

benefit eligibility and a limited transitional benefit for eligible participants continued to accrue through 2015).

Prior to this freezing of benefit accruals, the aggregate amount of these named officers’ total monthly

pension benefit under the Qualified Plan and Supplemental Plan was equal to the participant’s years of service

since 1999 (up to a maximum of 30 years) multiplied by the sum of (i) 0.5% of his or her final average pay plus

(ii) 0.5% of his or her final average pay in excess of his or her Social Security covered compensation, where

“final average pay” was defined as the participant’s average monthly compensation during the 60 consecutive

month period within his or her last ten years of employment in which he or she received his or her highest

compensation. Effective December 31, 2010, the Qualified Plan and Supplemental Plan were amended to cease

all future benefit accruals under the above formula (except where a collective bargaining agreement provides

otherwise). In lieu of additional accruals under the above-described formula, each affected participant’s accrued

benefit as of December 31, 2010 increases 4% per year, compounded annually through the earlier of

December 31, 2015 or the termination of the participant’s employment.

Under both Pension Plans, “average monthly compensation” is determined based on the participant’s salary

plus annual cash incentive bonus. Although the retirement benefits described above are provided through

separate plans, we have in the past transferred benefits from the Supplemental Plan to the Qualified Plan, and

reserve the right to make further similar transfers to the extent allowed under applicable law. The value of

benefits transferred to the Qualified Plan, which directly offset the value of benefits in the Supplemental Plan,

will be payable to the recipients in the form of enhanced annuities or supplemental benefits and are reflected in

the table above under the “Present Value of Accumulated Benefits” column.

The normal form of benefit payment under both of our Pension Plans is (i) in the case of unmarried

participants, a monthly annuity payable for the life of the participant, and (ii) in the case of married participants,

an actuarially equivalent monthly annuity payable for the lifetime of the participant and a survivor annuity

payable for the lifetime of the spouse upon the participant’s death. Participants may elect optional forms of

annuity benefits under each Pension Plan and, in the case of the Qualified Plan, an annuity that guarantees ten

years of benefits, all of which are actuarially equivalent in value to the normal form of benefit. The enhanced

annuities described in the prior paragraph may be paid in the form of a lump sum, at the participant’s election.

The normal retirement age is 65 under both of the Pension Plans. Participants may receive benefits under

both of these plans upon “early retirement,” which is defined as attaining age 55 with five years of service. Under

both of these plans, the benefit payable upon early termination is calculated under formulas that pay between

60% to 100% of the base plan benefit and 48% to 92% of the excess plan benefit, in each case with the lowest

percentage applying to early retirement at age 55 and proportionately higher percentages applying to early

66