CenturyLink 2015 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

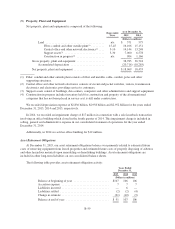

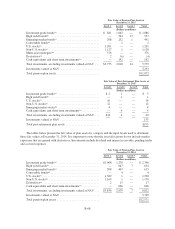

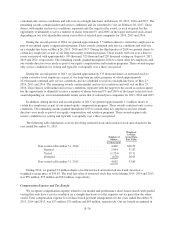

Fair Value of Pension Plan Assets at

December 31, 2015

Level 1 Level 2 Level 3 Total

(Dollars in millions)

Investment grade bonds(a) ............................ $ 841 1,045 — $ 1,886

High yield bonds(b) .................................. — 544 13 557

Emerging market bonds(c) ............................ 208 232 1 441

Convertible bonds(d) ................................. — 2 — 2

U.S. stocks(f) ...................................... 1,201 — — 1,201

Non-U.S. stocks(g) .................................. 1,127 1 — 1,128

Multi-asset strategies(m) .............................. 376 — — 376

Derivatives(n) ...................................... 2 (6) — (4)

Cash equivalents and short-term investments(o) ........... — 192 — 192

Total investments, excluding investments valued at NAV . . . $3,755 2,010 14 5,779

Investments valued at NAV ........................... 5,293

Total pension plan assets ............................. $11,072

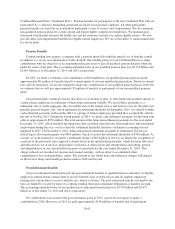

Fair Value of Post-Retirement Plan Assets at

December 31, 2015

Level 1 Level 2 Level 3 Total

(Dollars in millions)

Investment grade bonds(a) ............................ $ 2 1 — $ 3

High yield bonds(b) .................................. — 1 — 1

U.S. stocks(f) ....................................... 16 — — 16

Non-U.S. stocks(g) .................................. 12 — — 12

Emerging market stocks(h) ............................ 4 — — 4

Cash equivalents and short-term investments(o) ............ — 4 — 4

Total investments, excluding investments valued at NAV . . . $34 6 — 40

Investments valued at NAV ........................... 153

Total post-retirement plan assets ....................... $193

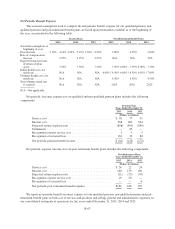

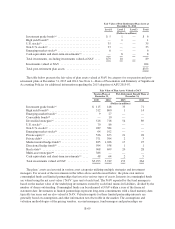

The tables below present the fair value of plan assets by category and the input levels used to determine

those fair values at December 31, 2014. It is important to note that the asset allocations do not include market

exposures that are gained with derivatives. Investments include dividend and interest receivable, pending trades

and accrued expenses.

Fair Value of Pension Plan Assets at

December 31, 2014

Level 1 Level 2 Level 3 Total

(Dollars in millions)

Investment grade bonds(a) ............................ $1,068 1,278 — $ 2,346

High yield bonds(b) .................................. — 647 7 654

Emerging market bonds(c) ............................ 208 407 — 615

Convertible bonds(d) ................................. — 4 — 4

U.S. stocks(f) ...................................... 1,389 1 — 1,390

Non-U.S. stocks(g) .................................. 1,169 1 — 1,170

Derivatives(n) ...................................... 2 15 — 17

Cash equivalents and short-term investments(o) ........... — 626 — 626

Total investments, excluding investments valued at NAV . . . $3,836 2,979 7 6,822

Investments valued at NAV ........................... 5,749

Total pension plan assets ............................. $12,571

B-68