CenturyLink 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

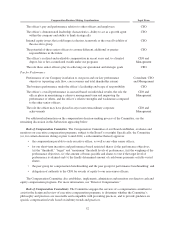

(1) Linear interpolation is used when our relative TSR performance is between the threshold, target and

maximum amounts to determine the corresponding percentage of the target award earned.

An overview of our absolute revenue performance-based restricted shares granted in 2015 is outlined

below.

• Performance Benchmark: An absolute revenue target over the below-described three-year performance

period, which is equal to the sum of three annual absolute revenue targets separately established by the

Committee during the first quarter of the years 2015, 2016, and 2017. “Absolute revenue” is defined as

the sum of our consolidated legacy and strategic revenue, in each case defined in the same manner we

reported such amounts in our Annual Report on Form 10-K for the prior year.

•Performance Period: January 1, 2015 through December 31, 2017.

• Performance Vesting: The ultimate number of our absolute revenue performance-based restricted

shares that vest will be based on our achievement of the aggregate three-year absolute revenue target,

as illustrated in the table below; provided, however, none of our absolute revenue performance-based

restricted shares will vest unless we attain a 6% operating cash flow annual return on average assets

during the performance period. Upon completion of the fiscal year, if necessary, our actual operating

results are adjusted in accordance with the Committee’s long-standing guidelines that are designed to

eliminate the effects of extraordinary or non-recurring transactions that were not known, anticipated or

quantifiable on the date the performance goals were established. The Committee intends to use these

same guidelines to adjust, as necessary, our actual revenues over the three-year performance period

with respect to the absolute revenue performance-based restricted shares awarded in 2015.

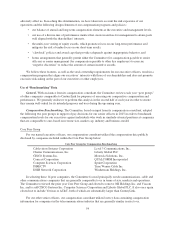

Absolute Revenue

Performance Level Company’s Performance(1)

Payout as % of

Target

Award(2)

Maximum .......................... ≥103.5% 200%

Target ............................. 100.0% 100%

Threshold .......................... 96.5% 50%

Below Threshold .................... <96.5% 0%

(1) Sum of absolute revenue actually attained for the years 2015, 2016 and 2017 divided by the sum of absolute

revenue targets separately established for each of the years 2015, 2016 and 2017.

(2) Linear interpolation is used when our absolute revenue performance is between the threshold, target and

maximum amounts to determine the corresponding percentage of target award earned.

For additional information on the above-described grants, see “Executive Compensation – Incentive

Compensation and Other Awards.”

2015 Executive Grants. Following its prior deliberations in late 2014, the Committee formally approved in

February 2015 an increase to the targeted aggregate grant date fair value of Mr. Post’s equity award from

$7,500,000 to $8,500,000. This increase was the result of the Committee’s recognition of Mr. Post’s overall

leadership and performance demonstrated in 2014 and acknowledgment of his role in the execution of our

business strategy, as well as the Committee’s review of compensation benchmarking. See further discussion

under the heading “– Use of ‘Benchmarking’ Data – Performance Benchmarking” in Subsection IV below. The

Committee granted equity awards to our senior officers on terms and in amounts substantially similar to the

awards granted to them in 2014.

47