CenturyLink 2015 Annual Report Download - page 141

Download and view the complete annual report

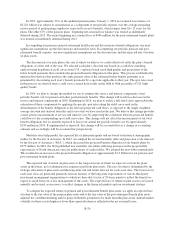

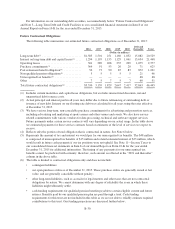

Please find page 141 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For additional information, see “Note 17—Repurchase of CenturyLink, Inc. Common Stock” in Item 8 of our

Annual Report on Form 10-K for the year ended December 31, 2015.

On October 13, 2015, Qwest Corporation redeemed all $250 million of its 7.2% Notes due 2026, which

resulted in an immaterial gain, and redeemed $150 million of its 6.875% Notes due 2033, which resulted in an

immaterial loss.

On September 21, 2015, Qwest Corporation issued $400 million aggregate principal amount of 6.625%

Notes due 2055, in exchange for net proceeds, after deducting underwriting discounts and other expenses, of

approximately $386 million. The underwriting agreement included an over-allotment option granting the

underwriters for the offering an opportunity to purchase additional 6.625% Notes due 2055. On September 30,

2015, Qwest Corporation issued an additional $10 million aggregate principal amount of its 6.625% Notes under

this over-allotment option. All of the 6.625% Notes are unsecured obligations and may be redeemed by Qwest

Corporation, in whole or in part, on or after September 15, 2020, at a redemption price equal to 100% of the

principal amount redeemed plus accrued and unpaid interest to the redemption date.

On June 15, 2015, Qwest Corporation paid at maturity the $92 million principal amount of its 7.625%

Notes.

On March 19, 2015, CenturyLink, Inc. issued in a private offering $500 million aggregate principal amount

of 5.625% Notes due 2025, in exchange for net proceeds, after deducting underwriting discounts and other

expenses, of approximately $494 million. The Notes are senior unsecured obligations and may be redeemed, in

whole or in part, at any time before January 1, 2025 at a redemption price equal to the greater of 100% of the

principal amount of the Notes or the sum of the present value of the remaining scheduled payments of principal

and interest on the Notes, discounted to the redemption date in the manner described in the Notes, plus accrued

and unpaid interest to the redemption date. At any time on or after January 1, 2025, CenturyLink, Inc. may

redeem the Notes at par plus accrued and unpaid interest to the redemption date. In addition, at any time on or

prior to April 1, 2018, CenturyLink, Inc. may redeem up to 35% of the principal amount of the Notes at a

redemption price equal to 105.625% of the principal amount thereof, plus accrued and unpaid interest to the

redemption date, with net cash proceeds of certain equity offerings. Under certain circumstances, CenturyLink,

Inc. will be required to make an offer to repurchase the Notes at a price of 101% of the aggregate principal

amount plus accrued and unpaid interest to the repurchase date. In October 2015, CenturyLink, Inc. exchanged

all of the unregistered Notes issued on March 19, 2015 for fully-registered Notes.

On February 20, 2015, Qwest Corporation entered into a new credit agreement with several lenders that

allows Qwest Corporation to borrow up to $100 million under a term loan. Under this new credit agreement,

Qwest Corporation borrowed $100 million under a ten-year term note that expires on February 20, 2025.

On February 17, 2015, CenturyLink, Inc. paid at maturity the $350 million plus accrued and unpaid interest

due under its Series M 5.00% notes.

In January 2015, CenturyLink, Inc. entered into a $100 million uncommitted revolving line of credit with

one of the lenders under the Credit Facility.

Certain Matters Related to Acquisitions

When we acquired Qwest and Savvis in 2011, Qwest’s pre-acquisition debt obligations consisted primarily

of debt securities issued by Qwest and two of its subsidiaries while Savvis’ long-term debt obligations (after the

discharge of its convertible senior notes in connection with the completion of the acquisition) consisted primarily

of capital leases, the remaining outstanding portions of which are all now included in our consolidated debt

balances. The indentures governing Qwest’s remaining debt securities contain customary covenants that restrict

the ability of Qwest or its subsidiaries from making certain payments and investments, granting liens and selling

B-33