CenturyLink 2015 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

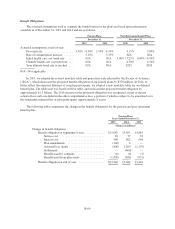

Post-Retirement Benefit Plans

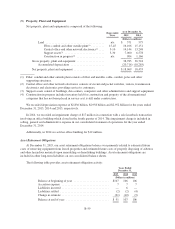

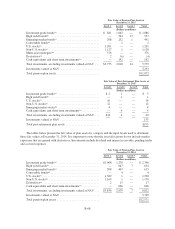

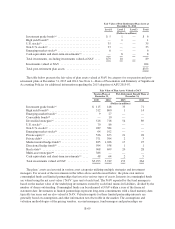

Years Ended December 31,

2015 2014 2013

(Dollars in millions)

Change in plan assets

Fair value of plan assets at beginning of year ........... $353 535 626

Return on plan assets .............................. 3 37 45

Benefits paid from plan assets ....................... (163) (219) (136)

Fair value of plan assets at end of year .................... $193 353 535

Pension Plans: Our investment objective for the qualified pension plan assets is to achieve an attractive

risk-adjusted return over time that will provide for the payment of benefits and minimize the risk of large losses.

Our pension plan investment strategy is designed to meet this objective by broadly diversifying plan assets across

numerous strategies with differing expected returns, volatilities and correlations. The pension plan assets have

target allocations of 45% to interest rate sensitive investments and 55% to investments designed to provide

higher expected returns than the interest rate sensitive investments. Interest rate sensitive investments include

30% of plan assets targeted primarily to long-duration investment grade bonds, 10% targeted to high yield and

emerging market bonds and 5% targeted to diversified strategies, which primarily have exposures to global

bonds, as well as some exposures to global stocks and commodities. Assets expected to provide higher returns

than the interest rate sensitive assets include broadly diversified equity investments with targets of approximately

15% to U.S. equity markets and 15% to non-U.S. developed and emerging markets. Approximately 7% is

targeted to broadly diversified multi-asset class strategies that have the flexibility to adjust exposures to different

asset classes. Approximately 10% is allocated to private markets investments including funds primarily invested

in private equity, private debt and hedge funds. Real estate investments are targeted at 8% of plan assets. At the

beginning of 2016, our expected annual long-term rate of return on pension assets before consideration of

administrative expenses is assumed to be 7.5%. However, projected increases in PBGC (Pension Benefit

Guaranty Corporation) premium rates have now become large enough to reduce the annual long-term expected

return net of administrative expenses to 7.0%.

Our non-qualified pension plans are not funded. We pay benefits directly to the participants of these plans.

Post-Retirement Benefit Plans: Our investment objective for the post-retirement benefit plans’ assets is to

achieve an attractive risk-adjusted return and minimize the risk of large losses over the expected life of the assets.

Investment risk is managed by broadly diversifying assets across numerous strategies with differing expected

returns, volatilities and correlations. Our investment strategy is designed to be consistent with the investment

objective, with particular focus on providing liquidity for the reimbursement of our union-represented

employees’ post-retirement health care costs. The liquid post-retirement benefit plan assets (excluding private

market investments) have target allocations of 20% to equities and 80% to non-equity investments. Specific

target allocations within these broad categories are allowed to vary to meet reimbursement requirements. Liquid

equity investments are broadly diversified with exposure to publicly traded U.S., non-U.S. and emerging market

stocks. The 80% non-equity allocation includes investment grade bonds, real estate, hedge funds and diversified

strategies. While no new private market investments have been made in recent years, the percent allocation to

existing private market investments is expected to increase as liquid, publicly traded stocks are drawn down for

the reimbursement of health care costs. At the beginning of 2016, our expected annual long-term rate of return on

post-retirement benefit plan assets is assumed to be 7.0%.

Permitted investments: Plan assets are managed consistent with the restrictions set forth by the Employee

Retirement Income Security Act of 1974, as amended, which requires diversification of assets and also generally

prohibits defined benefit and welfare plans from investing more than 10% of their assets in securities issued by

the sponsor company. At December 31, 2015 and 2014, the pension and post-retirement benefit plans did not

directly own any shares of our common stock or any of our debt.

B-66