CenturyLink 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

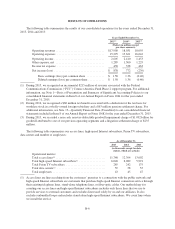

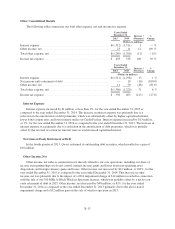

Other Consolidated Results

The following tables summarize our total other expense, net and income tax expense:

Years Ended

December 31, Increase /

(Decrease)

%

Change2015 2014

(Dollars in millions)

Interest expense .............................................. $(1,312) (1,311) 1 — %

Other income, net ............................................. 23 11 12 109%

Total other expense, net ........................................ $(1,289) (1,300) (11) (1)%

Income tax expense ........................................... $ 438 338 100 30%

Years Ended

December 31, Increase /

(Decrease)

%

Change2014 2013

(Dollars in millions)

Interest expense .............................................. $(1,311) (1,298) 13 1 %

Net gain on early retirement of debt .............................. — 10 (10) (100)%

Other income, net ............................................. 11 59 (48) (81)%

Total other expense, net ........................................ $(1,300) (1,229) 71 6 %

Income tax expense ........................................... $ 338 463 (125) (27)%

Interest Expense

Interest expense increased by $1 million, or less than 1%, for the year ended December 31, 2015 as

compared to the year ended December 31, 2014. The increase in interest expense was primarily due to a

reduction in the amortization of debt premiums, which was substantially offset by higher capitalized interest,

lower bond coupon rates and lower interest under our Credit Facility. Interest expense increased by $13 million,

or 1%, for the year ended December 31, 2014 as compared to the year ended December 31, 2013. The increase in

interest expense was primarily due to a reduction in the amortization of debt premiums, which was partially

offset by the reversal of certain tax interest reserves and increased capitalized interest.

Net Gain on Early Retirement of Debt

In the fourth quarter of 2013, Qwest redeemed its outstanding debt securities, which resulted in a gain of

$10 million.

Other Income, Net

Other income, net reflects certain items not directly related to our core operations, including our share of

income from partnerships we do not control, interest income, gains and losses from non-operating asset

dispositions and foreign currency gains and losses. Other income, net increased by $12 million, or 109%, for the

year ended December 31, 2015 as compared to the year ended December 31, 2014. This increase in other

income, net was primarily due to the impact of a 2014 impairment charge of $14 million recorded in connection

with the sale of our 700 MHz A-Block Wireless Spectrum licenses, which was partially offset by a net loss on

early retirement of debt in 2015. Other income, net decreased by $48 million, or 81%, for the year ended

December 31, 2014 as compared to the year ended December 31, 2013 primarily due to the above-noted

impairment charge and a $32 million gain on the sale of wireless spectrum in 2013.

B-13