CenturyLink 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• certain post-retirement benefits payable to certain eligible current and future retirees. Not all of our

post-retirement benefit obligation amount is a contractual obligation and only the portion that we

believe is a contractual obligation is reported in the table. See additional information on our benefits

plans in Note 7—Employee Benefits to our consolidated financial statements in Item 8 of our Annual

Report on Form 10-K for the year ended December 31, 2015;

• contract termination fees. These fees are non-recurring payments, the timing and payment of which, if

any, is uncertain. In the ordinary course of business and to optimize our cost structure, we enter into

contracts with terms greater than one year to use the network facilities of other carriers and to purchase

other goods and services. Our contracts to use other carriers’ network facilities generally have no

minimum volume requirements and are based on an interrelationship of volumes and discounted rates.

Assuming we terminate these contracts in 2016, the contract termination fees would be approximately

$399 million. Under the same assumption, we estimate that our termination fees for these contracts to

purchase goods and services would be approximately $154 million. In the normal course of business,

we do not believe payment of these fees is likely; and

• potential indemnification obligations to counterparties in certain agreements entered into in the normal

course of business. The nature and terms of these arrangements vary.

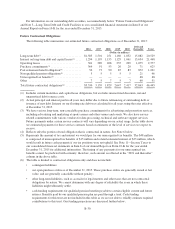

Pension and Post-retirement Benefit Obligations

We are subject to material obligations under our existing defined benefit pension plans and post-retirement

benefit plans. At December 31, 2015, the accounting unfunded status of our defined benefit pension plans and

post-retirement benefit plans were $2.277 billion and $3.374 billion, respectively. See Note 7—Employee

Benefits to our consolidated financial statements in Item 8 of our Annual Report on Form 10-K for the year

ended December 31, 2015 for additional information about our pension and post-retirement benefit

arrangements.

Benefits paid by our qualified pension plan are paid through a trust that holds all of the plan’s assets. Based

on current laws and circumstances, we do not expect any contributions to be required for our qualified pension

plan for 2016. The amount of required contributions to our qualified pension plan in 2017 and beyond will

depend on a variety of factors, most of which are beyond our control, including earnings on plan investments,

prevailing interest rates, demographic experience, changes in plan benefits and changes in funding laws and

regulations. We occasionally make voluntary contributions in addition to required contributions.

Certain of our post-retirement health care and life insurance benefits plans are unfunded. Several trusts hold

assets that are used to help cover the health care costs of certain retirees. As of December 31, 2015, the fair value

of these trust assets was approximately $193 million; however, a portion of these assets is comprised of

investments with restricted liquidity. We estimate that the more liquid assets in these trusts will be adequate to

provide continuing reimbursements for covered post-retirement health care costs for approximately one year.

Thereafter, covered benefits will be paid either directly by us or from these trusts as the remaining assets become

liquid. This projected one year period could be shorter or longer depending on returns on plan assets, the timing

of maturities of illiquid plan assets and future changes in benefits.

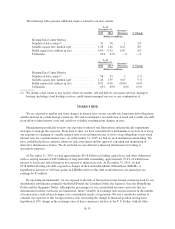

For 2016, our estimated annual long-term rate of return is 7.0% for both the pension plan trust assets and

post-retirement plans trust assets, based on the assets currently held. However, actual returns could be

substantially different.

B-31