CenturyLink 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.All shares of the relative performance-based restricted stock will vest if we perform at the “target”

performance level, which is attaining total shareholder return over the three-year performance period equal to the

50th percentile of the total shareholder return of the companies in a 26-company TSR peer group for the same

three-year period. Each named executive officer will receive a greater or lesser number of shares of relative

performance-based restricted stock depending on our actual total shareholder return in relation to that of the

26 TSR peer companies, as discussed further under “Compensation Discussion and Analysis — Our

Compensation Program Objectives and Components of Pay — Long-Term Equity Incentive Compensation.”

None of the shares of absolute performance-based restricted stock will vest unless we attain at least a 6%

operating cash flow annual return on average assets during the performance period. If we do, all shares of the

absolute performance-based restricted stock will vest if we attain the “target” amount of our consolidated legacy

and strategic revenue (as defined in our federal securities law reports) over the three-year performance period.

This target amount of such revenue over this three-year period will equal the sum of (i) the amounts of targeted

legacy and strategic revenue for 2015 and 2016 as determined by the Committee in early 2015 and 2016,

respectively, and (ii) the amount of targeted legacy and strategic revenue for 2017 to be determined by the

Committee in early 2017. Each named executive officer will receive a greater or lesser number of shares of

absolute performance-based restricted stock depending on our actual absolute revenues over the performance

period, as discussed further under “Compensation Discussion and Analysis — Our Compensation Program

Objectives and Components of Pay — Long-Term Equity Incentive Compensation.”

Any contingent right of a named executive officer to receive more than the number of shares actually

granted on February 23, 2015 are treated by us as restricted stock units under the terms of the CenturyLink 2011

Equity Incentive Plan.

Other Terms. All dividends related to shares of the above-described time-vested and performance-based

restricted stock will be paid to the holder only upon the vesting of such shares. Unless and until forfeited, these

shares may be voted by the named executive officers.

All of these above-described restricted shares are subject to forfeiture if the officer competes with us or

engages in certain other activities harmful to us, all as specified further in the forms of incentive agreements that

we have filed with the SEC. See “— Potential Termination Payments.”

For additional information about our grants of time-vested restricted stock, relative performance-based

restricted stock (including the 26-company TSR peer group referred to above) and absolute performance-based

restricted stock, see “Compensation Discussion and Analysis — Our Compensation Program Objectives and

Components of Pay — Long-Term Equity Incentive Compensation.”

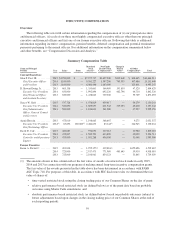

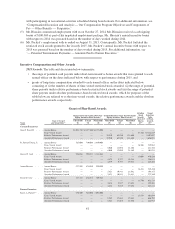

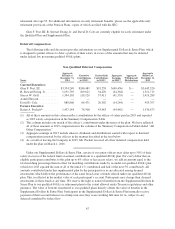

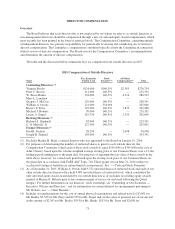

Outstanding Awards. The table below summarizes information on stock options and unvested restricted

stock outstanding at December 31, 2015.

63