CenturyLink 2015 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

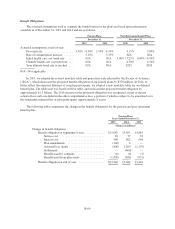

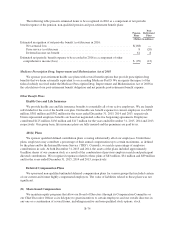

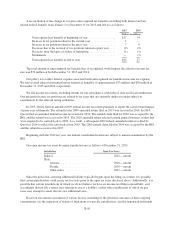

The following table presents estimated items to be recognized in 2016 as a component of net periodic

benefit expense of the pension, non-qualified pension and post-retirement benefit plans:

Pension

Plans

Post-

Retirement

Plans

(Dollars in millions)

Estimated recognition of net periodic benefit (cost)/income in 2016:

Net actuarial loss ........................................................ $(168) —

Prior service (cost)/income ................................................ 8 (20)

Deferred income tax benefit ............................................... 61 8

Estimated net periodic benefit expense to be recorded in 2016 as a component of other

comprehensive income (loss) ................................................ $ (99) (12)

Medicare Prescription Drug, Improvement and Modernization Act of 2003

We sponsor post-retirement health care plans with several benefit options that provide prescription drug

benefits that we deem actuarially equivalent to or exceeding Medicare Part D. We recognize the impact of the

federal subsidy received under the Medicare Prescription Drug, Improvement and Modernization Act of 2003 in

the calculation of our post-retirement benefit obligation and net periodic post-retirement benefit expense.

Other Benefit Plans

Health Care and Life Insurance

We provide health care and life insurance benefits to essentially all of our active employees. We are largely

self-funded for the cost of the health care plan. Our health care benefit expense for current employees was $381

million, $381 million and $362 million for the years ended December 31, 2015, 2014 and 2013, respectively.

Union-represented employee benefits are based on negotiated collective bargaining agreements. Employees

contributed $125 million, $136 million and $117 million for the years ended December 31, 2015, 2014 and 2013,

respectively. Our group basic life insurance plans are fully insured and the premiums are paid by us.

401(k) Plans

We sponsor qualified defined contribution plans covering substantially all of our employees. Under these

plans, employees may contribute a percentage of their annual compensation up to certain maximums, as defined

by the plans and by the Internal Revenue Service (“IRS”). Currently, we match a percentage of employee

contributions in cash. At both December 31, 2015 and 2014, the assets of the plans included approximately

8 million shares of our common stock as a result of the combination of previous employer match and participant

directed contributions. We recognized expenses related to these plans of $83 million, $81 million and $89 million

and for the years ended December 31, 2015, 2014 and 2013, respectively.

Deferred Compensation Plans

We sponsored non-qualified unfunded deferred compensation plans for various groups that included certain

of our current and former highly compensated employees. The value of liabilities related to these plans was not

significant.

(8) Share-based Compensation

We maintain equity programs that allow our Board of Directors (through its Compensation Committee or

our Chief Executive Officer as its delegate) to grant incentives to certain employees and our outside directors in

any one or a combination of several forms, including incentive and non-qualified stock options, stock

B-74