CenturyLink 2015 Annual Report Download - page 133

Download and view the complete annual report

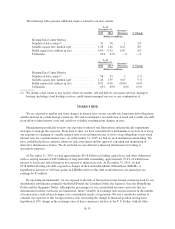

Please find page 133 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Changes in any of the above factors could significantly impact operating expenses in the consolidated

statements of operations and other comprehensive income (loss) in the consolidated statements of comprehensive

income (loss) as well as the value of the liability and accumulated other comprehensive loss of stockholders’

equity on our consolidated balance sheets. The expected return on plan assets is reflected as a reduction to our

pension and post-retirement benefit expense. If our assumed expected rates of return for 2015 were 100 basis

points lower, our qualified pension and post-retirement benefit expenses for 2015 would have increased by

$121 million. If our assumed discount rates for 2015 were 100 basis points lower, our qualified pension and post-

retirement benefit expenses for 2015 would have increased by $119 million and our projected benefit obligation

for 2015 would have increased by approximately $1.821 billion.

Loss Contingencies and Litigation Reserves

We are involved in several material legal proceedings, as described in more detail in Note 14—

Commitments and Contingencies to our consolidated financial statements in Item 8 of our Annual Report on

Form 10-K for the year ended December 31, 2015. We assess potential losses in relation to these and other

pending or threatened tax and legal matters. For matters not related to income taxes, if a loss is considered

probable and the amount can be reasonably estimated, we recognize an expense for the estimated loss. To the

extent these estimates are more or less than the actual liability resulting from the resolution of these matters, our

earnings will be increased or decreased accordingly. If the differences are material, our consolidated financial

statements could be materially impacted.

For matters related to income taxes, if we determine in our judgment that the impact of an uncertain tax

position is more likely than not to be sustained upon audit by the relevant taxing authority, then we recognize in

our financial statements a benefit for the largest amount that is more likely than not to be sustained. No portion of

an uncertain tax position will be recognized if we determine in our judgment that the position has less than a 50%

likelihood of being sustained. Though the validity of any tax position is a matter of tax law, the body of statutory,

regulatory and interpretive guidance on the application of the law is complex and often ambiguous. Because of

this, whether a tax position will ultimately be sustained may be uncertain.

Connect America Fund Support Payments

In 2015, we accepted funding from the Connect America Fund (“CAF)” from the Federal Communications

Commission (“FCC”) of approximately $500 million per year for six years to fund the deployment of voice and

high-speed Internet infrastructure for approximately 1.2 million rural households and businesses (living units) in

33 states under the CAF Phase 2 high-cost support program. This program provides a monthly high-cost subsidy

similar to the support provided by the FCC’s previous cost reimbursement programs. Although we believe that

there is no specific authoritative U.S. GAAP guidance for the treatment of government assistance, we identified

three acceptable methods to account for these funds; 1) recognize revenue when entitled to receive cash, 2) defer

cash received until the living units are enabled to receive the service at the FCC specified level, or 3) record the

cash received as contra capital. After assessing these alternatives, we have determined that we will recognize

CAF Phase 2 funds each month as revenue when we are entitled to receive the cash less a deferred amount. The

amount of revenue deferred in 2015 was approximately $12 million. We believe our recognition methodology is

consistent with other companies in our industry in the United States, but may not necessarily be consistent with

companies outside the United States that receive similar government funding, and we cannot provide assurances

to this effect.

In computing the amount of revenue to recognize, we assume that we will not be able to economically

enable 100% of the required living units in every state with voice and high-speed Internet capabilities under the

CAF Phase 2 program. We defer recognition of the funds related to potential living units that we estimate we will

not enable until we can precisely determine that we can fully meet the enablement targets. As disclosed

elsewhere herein, in some limited instances, a portion of the funds must be returned. The effect of a hypothetical

1% change in our estimate of living units we will not enable with voice and high-speed Internet capabilities

B-25