CenturyLink 2015 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

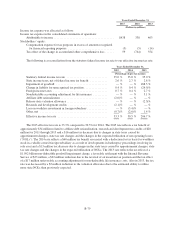

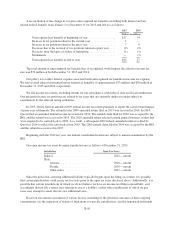

A reconciliation of the change in our gross unrecognized tax benefits (excluding both interest and any

related federal benefit) from January 1 to December 31 for 2015 and 2014 is as follows:

2015 2014

(Dollars in millions)

Unrecognized tax benefits at beginning of year .................. $17 14

Increase in tax positions taken in the current year ................ 1 —

Increase in tax positions taken in the prior year .................. 7 9

Decrease due to the reversal of tax positions taken in a prior year .... (9) (2)

Decrease from the lapse of statute of limitations ................. (1) (1)

Settlements ............................................... — (3)

Unrecognized tax benefits at end of year ....................... $15 17

The total amount of unrecognized tax benefits that, if recognized, would impact the effective income tax

rate was $32 million at both December 31, 2015 and 2014.

Our policy is to reflect interest expense associated with unrecognized tax benefits in income tax expense.

We had accrued interest (presented before related tax benefits) of approximately $33 million and $30 million at

December 31, 2015 and 2014, respectively.

We file income tax returns, including returns for our subsidiaries, with federal, state and local jurisdictions.

Our uncertain income tax positions are related to tax years that are currently under or remain subject to

examination by the relevant taxing authorities.

In 2013, Qwest filed an amended 2009 federal income tax return primarily to report the carryforward impact

of prior year settlements. The refund for the 2009 amended return filed in 2013 was received in 2014. In 2014,

Qwest filed an amended federal income tax return for 2010. The refund claim filed for 2010 was accepted by the

IRS, and the refund was received in 2015. The 2010 amended return released certain general business credits that

were required to be carried back to 2009. As a result, a subsequent 2009 federal amended return was filed by

Qwest in 2014 to reflect the carrybacks from 2010. The 2009 refund claim filed in 2014 was accepted by the IRS

and the refund was received in 2015.

Beginning with the 2012 tax year, our federal consolidated returns are subject to annual examination by the

IRS.

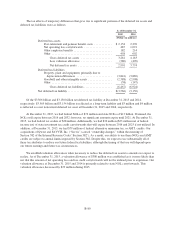

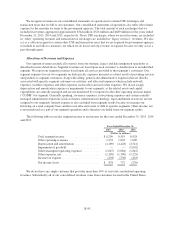

Our open income tax years by major jurisdiction are as follows at December 31, 2015:

Jurisdiction Open Tax Years

Federal ........................ 2012—current

State

Arizona .................... 2010—current

Florida .................... 2010—current

Other states ................. 2011—current

Since the period for assessing additional liability typically begins upon the filing of a return, it is possible

that certain jurisdictions could assess tax for years prior to the open tax years disclosed above. Additionally, it is

possible that certain jurisdictions in which we do not believe we have an income tax filing responsibility, and

accordingly did not file a return, may attempt to assess a liability, or that other jurisdictions to which we pay

taxes may attempt to assert that we owe additional taxes.

Based on our current assessment of various factors, including (i) the potential outcomes of these ongoing

examinations, (ii) the expiration of statute of limitations for specific jurisdictions, (iii) the negotiated settlement

B-81