CenturyLink 2015 Annual Report Download - page 179

Download and view the complete annual report

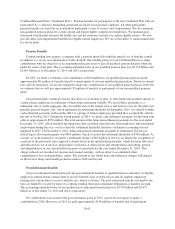

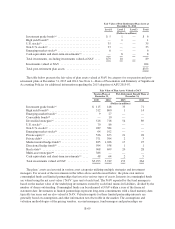

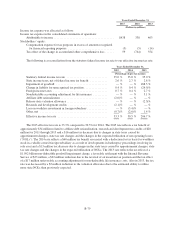

Please find page 179 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(h) Emerging market stocks represent investments in a registered mutual fund and commingled funds

comprised of stocks of companies located in developing markets. Registered mutual funds trade at the daily

NAV, as determined by the market value of the underlying investments, and are classified as Level 1. The

commingled funds are valued at NAV based on the market value of the underlying investments using the same

valuation inputs described previously for individual stocks.

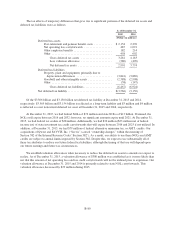

(i) Private equity represents non-public investments in domestic and foreign buy out and venture

capital funds. Private equity funds are structured as limited partnerships and are valued according to the valuation

policy of each partnership, subject to prevailing accounting and other regulatory guidelines. The partnerships are

valued at NAV using valuation methodologies that give consideration to a range of factors, including but not

limited to the price at which investments were acquired, the nature of the investments, market conditions, trading

values on comparable public securities, current and projected operating performance, and financing transactions

subsequent to the acquisition of the investments. These valuation methodologies involve a significant degree of

judgment.

(j) Private debt represents non-public investments in distressed or mezzanine debt funds. Mezzanine

debt instruments are debt instruments that are subordinated to other debt issues and may include embedded

equity instruments such as warrants. Private debt funds are structured as limited partnerships and are valued at

NAV according to the valuation policy of each partnership, subject to prevailing accounting and other regulatory

guidelines. The valuation of underlying fund investments are based on factors including the issuer’s current and

projected credit worthiness, the security’s terms, reference to the securities of comparable companies, and other

market factors. These valuation methodologies involve a significant degree of judgment.

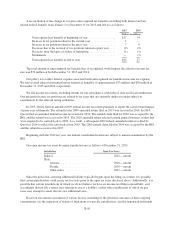

(k) Market neutral hedge funds hold investments in a diversified mix of instruments that are intended

in combination to exhibit low correlations to market fluctuations. These investments are typically combined with

futures to achieve uncorrelated excess returns over various markets. Directional hedge funds—This asset

category represents investments that may exhibit somewhat higher correlations to market fluctuations than the

market neutral hedge funds. Investments in hedge funds include both direct investments and investments in

diversified funds of funds. Hedge Funds are valued at NAV based on the market value of the underlying

investments which include publicly traded equity and fixed income securities and privately negotiated debt

securities. The hedge funds are valued by third party administrators using the same valuation inputs previously

described.

(l) Real estate represents investments in commingled funds and limited partnerships that invest in a

diversified portfolio of real estate properties. These investments are valued at NAV according to the valuation

policy of each fund or partnership, subject to prevailing accounting and other regulatory guidelines. The

valuation inputs of the underlying properties are generally based on third-party appraisals that use comparable

sales or a projection of future cash flows to determine fair value.

(m) Multi-asset strategies is a new allocation in 2015 and represents broadly diversified strategies that

have the flexibility to tactically adjust exposures to different asset classes through time. This asset category

includes investments in a registered mutual fund which is classified as Level 1 and a commingled fund which is

valued at NAV based on the market value of the underlying investments.

(n) Derivatives include exchange traded futures contracts which are classified as Level 1, as well as

privately negotiated over-the-counter swaps and options that are valued based on the change in interest rates or a

specific market index and are classified as Level 2. The market values represent gains or losses that occur due to

fluctuations in interest rates, foreign currency exchange rates, security prices, or other factors.

(o) Cash equivalents and short-term investments represent investments that are used in conjunction

with derivatives positions or are used to provide liquidity for the payment of benefits or other purposes. The

valuation inputs of securities are based on a spread to U.S. Treasury Bills, the Federal Funds Rate, or London

B-71