CenturyLink 2015 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Term Loans, Revolving Line of Credit and Revolving Letter of Credit

On March 13, 2015, CenturyLink, Inc. amended its term loan agreement to reduce the interest rate payable

by it thereunder and to modify some covenants to provide additional flexibility.

On February 20, 2015, Qwest Corporation entered into a term loan in the amount of $100 million with

CoBank, ACB. The outstanding unpaid principal amount of this term loan plus any accrued and unpaid interest is

due on February 20, 2025. Interest is paid monthly based upon either the London Interbank Offered Rate

(“LIBOR”) or the base rate (as defined in the credit agreement) plus an applicable margin between 1.50% to

2.50% per annum for LIBOR loans and 0.50% to 1.50% per annum for base rate loans depending on Qwest

Corporation’s then current senior unsecured long-term debt rating. At December 31, 2015, the outstanding

principal balance on this term loan was $100 million.

In January 2015, CenturyLink, Inc. entered into a $100 million uncommitted revolving line of credit with

one of the lenders under the Credit Facility. The amount available under this uncommitted revolving line of

credit is reduced by any amount outstanding under the Credit Facility with the same lender. Interest is paid

monthly based upon the LIBOR plus an applicable margin between 1.00% and 2.25% per annum. At

December 31, 2015, CenturyLink, Inc. had $80 million borrowings outstanding under this uncommitted

revolving line of credit.

In April 2011, we entered into a $160 million uncommitted revolving letter of credit facility which enables

us to provide letters of credit under terms that may be more favorable than those under the Credit Facility. At

December 31, 2015 and 2014, our outstanding letters of credit totaled $109 million and $124 million,

respectively, under this facility.

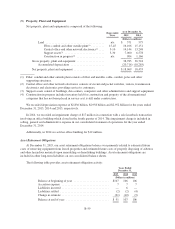

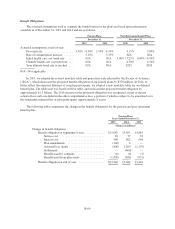

Aggregate Maturities of Long-Term Debt

Set forth below is the aggregate principal amount of our long-term debt (excluding unamortized discounts,

net and unamortized debt issuance costs) maturing during the following years:

(Dollars in millions)(1)

2016 ..................................... $ 1,503

2017 ..................................... 1,501

2018 ..................................... 251

2019 ..................................... 1,160

2020 ..................................... 1,032

2021 and thereafter ......................... 15,082

Total long-term debt ........................ $20,529

(1) Actual principal paid in all years may differ due to the possible future refinancing of outstanding debt or the

issuance of new debt.

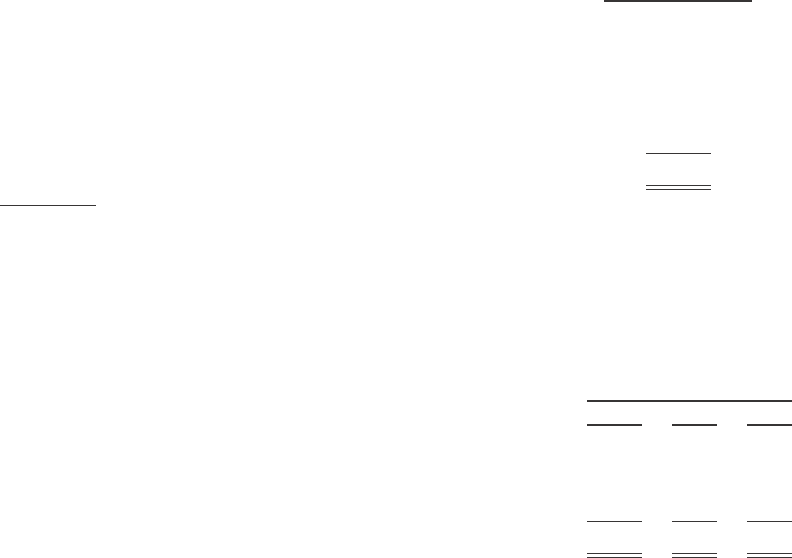

Interest Expense

Interest expense includes interest on long-term debt. The following table presents the amount of gross

interest expense, net of capitalized interest:

Years Ended December 31,

2015 2014 2013

(Dollars in millions)

Interest expense:

Gross interest expense ..................... $1,364 1,358 1,339

Capitalized interest ........................ (52) (47) (41)

Total interest expense .......................... $1,312 1,311 1,298

B-56