CenturyLink 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

or transferring assets. Based on current circumstances, we do not anticipate that these covenants will significantly

restrict our ability to manage cash balances or transfer cash between entities within our consolidated group of

companies as needed.

In accounting for the Qwest acquisition, we recorded Qwest’s debt securities at their estimated fair values,

which totaled $12.292 billion as of April 1, 2011. Our acquisition date fair value estimates were based primarily

on quoted market prices in active markets and other observable inputs where quoted market prices were not

available. We determined that the fair value of Qwest’s debt securities exceeded their stated principal balances

on the acquisition date by $693 million, which we recorded as a premium.

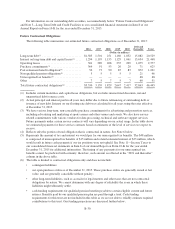

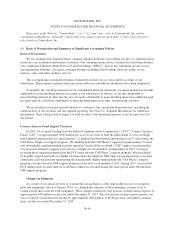

The table below summarizes the portions of this premium recognized as a reduction to interest expense or

extinguished during the periods indicated:

Years Ended

December 31, From April 1, 2011

through

December 31, 2013

Total Since

Acquisition2015 2014

(Dollars in millions)

Amortized ........................... $22 42 302 366

Extinguished(1) ....................... 1 — 276 277

Total ............................... $23 42 578 643

(1) Extinguished in connection with the payment of Qwest debt securities prior to maturity.

The remaining premium of $50 million as of December 31, 2015, will reduce interest expense in future

periods, unless otherwise extinguished.

Other Matters

In February 2015, the FCC adopted new regulations that regulate Internet services as a public utility under

Title II of the Communications Act. Although it is premature for us to determine the ultimate impact of the new

regulations on our operations, we currently expect that they will negatively impact our current operations. For

additional information, see “Risk Factors—Risks Relating to Legal and Regulatory Matters” in Item 1A of our

Annual Report on Form 10-K for the year ended December 31, 2015.

CenturyLink has cash management arrangements with certain of its principal subsidiaries, in which

substantial portions of the subsidiaries’ cash is regularly advanced to CenturyLink. Although CenturyLink

periodically repays these advances to fund the subsidiaries’ cash requirements throughout the year, at any given

point in time CenturyLink may owe a substantial sum to our subsidiaries under these advances, which, in

accordance with generally accepted accounting principles, are eliminated in consolidation and therefore not

recognized on our consolidated balance sheets.

We also are involved in various legal proceedings that could substantially impact our financial position. See

Note 14—Commitments and Contingencies to our consolidated financial statements in Item 8 of our Annual

Report on Form 10-K for the year ended December 31, 2015 for the current status of such legal proceedings.

On November 4, 2015, we announced that we have retained financial advisors to assist in the exploration of

strategic alternatives for our data centers and colocation business operations. The review of strategic alternatives

will involve a full range of options, including, but not limited to, a partnership or joint venture, a sale of all or a

portion of the data centers, as well as keeping some or all of these assets and operations as part of our portfolio.

Strategic services revenues generated from our colocation services was approximately $626 million, $644 million

and $623 million for the years ended December 31, 2015, 2014 and 2013, respectively.

B-34