CenturyLink 2015 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

appreciation rights, restricted stock awards, restricted stock units and market and performance shares. Stock

options generally expire ten years from the date of grant. Until June 30, 2014, we offered an employee stock

purchase plan, which allowed eligible employees to purchase our common stock at a 15% discount based on the

lower of the beginning or ending stock price during recurring six month offering periods.

Stock Options

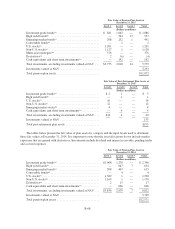

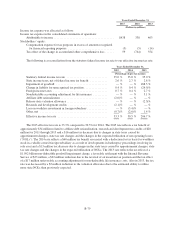

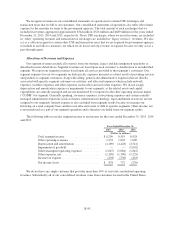

The following table summarizes activity involving stock option awards for the year ended December 31,

2015:

Number of

Options

Weighted-

Average

Exercise

Price

(in thousands)

Outstanding and Exercisable at December 31, 2014 . . . 4,106 $37.99

Exercised ................................ (335) 26.00

Forfeited/Expired .......................... (246) 30.33

Outstanding and Exercisable at December 31, 2015 . . . 3,525 39.67

The aggregate intrinsic value of our options outstanding and exercisable at December 31, 2015 was $1

million. The weighted average remaining contractual term for such options was 1.9 years.

During 2015, we received net cash proceeds of $9 million in connection with our option exercises. The tax

benefit realized from these exercises was $1 million. The total intrinsic value of options exercised for the years

ended December 31, 2015, 2014 and 2013, was $4 million, $9 million and $11 million, respectively.

Restricted Stock Awards

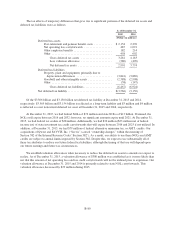

For equity based awards that contain only service conditions for vesting, we calculate the award fair value

based on the closing stock price on the accounting grant date. For equity based restricted stock awards that

contain market conditions, the award fair value is calculated through Monte-Carlo simulations.

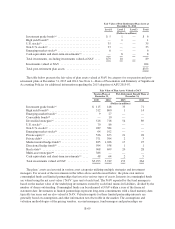

During the first quarter of 2015, we granted approximately 496 thousand shares of restricted stock to certain

executive-level employees as part of our long-term incentive program, of which approximately 198 thousand

contained only service conditions and will vest on a straight-line basis on February 23, 2016, 2017 and 2018. The

remaining awards contain market and service conditions and are scheduled to vest on February 23, 2018. These

shares, with market and service conditions, represent only the target for the award, as each recipient has the

opportunity to ultimately receive a number of shares between 0% and 200% of the target restricted stock award

depending on our total shareholder return versus that of selected peer companies for 2015, 2016 and 2017.

At the end of the first quarter of 2015, we granted approximately 1.2 million shares to certain key

employees as part of our annual equity compensation program. These awards contained only service conditions

and will vest on a straight-line basis on March 12, 2016, 2017 and 2018. During the third quarter of 2015 we

granted shares to certain key employees as part of our long-term equity retention program. These awards will

vest over a three to seven year period with approximately 193 thousand, 423 thousand and 230 thousand shares

vesting on August 14, 2018, 2020 and 2022, respectively, and 55 thousand shares vesting equally on August 14,

2017, 2019, and 2021. The remaining awards granted throughout 2015 to certain other key employees and our

outside directors were made as part of our equity compensation and retention programs. These awards require

only service conditions for vesting and typically vest equally over a three year period.

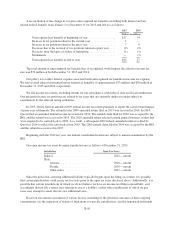

During the first quarter of 2014, we granted approximately 440 thousand shares of restricted stock to certain

executive-level employees as part of our long-term incentive program, of which approximately 250 thousand

B-75