CenturyLink 2015 Annual Report Download - page 130

Download and view the complete annual report

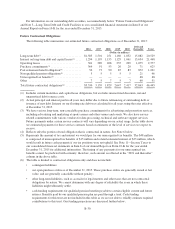

Please find page 130 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.software using the straight-line method over estimated lives ranging up to 7 years, except for approximately

$237 million of our capitalized software costs, which represents costs to develop an integrated billing and

customer care system which is amortized using the straight-line method over a 20 year period. We annually

review the estimated lives and methods used to amortize our other intangible assets, primarily capitalized

software. The amount of future amortization expense may differ materially from current amounts, depending on

the results of our annual reviews.

Our goodwill was derived from numerous acquisitions where the purchase price exceeded the fair value of

the net assets acquired.

We are required to reassign goodwill to reporting units each time we reorganize our internal reporting

structure which causes a change in the composition of our reporting units. We assign goodwill to the reporting

units using a relative fair value approach. We utilize the trailing twelve months earnings before interest, taxes,

depreciation and amortization as our allocation methodology as we believe that it represents a reasonable proxy

for the fair value of the operations being reorganized. The use of other fair value assignment methods could

result in materially different results. For additional information on our segments, see Note 12—Segment

Information to our consolidated financial statements in Item 8 of our Annual Report on Form 10-K for the year

ended December 31, 2015.

We are required to assess goodwill for impairment at least annually, or more frequently, if an event occurs

or circumstances change that would indicate an impairment may have occurred. We are required to write-down

the value of goodwill in periods in which the recorded amount of goodwill exceeds the implied fair value of

goodwill. Our reporting units are not discrete legal entities with discrete financial statements. Our assets and

liabilities are employed in and relate to the operations of our reporting units. Therefore, the equity carrying value

and future cash flows must be estimated each time a goodwill impairment analysis is performed on a reporting

unit. As a result, our assets, liabilities and cash flows are assigned to reporting units using reasonable and

consistent allocation methodologies. Certain estimates, judgments and assumptions are required to perform these

assignments. We believe these estimates, judgments and assumptions to be reasonable, but changes in many of

these can significantly affect each reporting unit’s equity carrying value and future cash flows utilized for our

goodwill impairment test. Our annual assessment date for testing goodwill impairment is October 31.

As of October 31, 2015, we assessed goodwill for impairment for our three reporting units, which we

determined to be business (excluding wholesale), consumer and wholesale and determined that the estimated fair

value of our wholesale reporting unit was substantially in excess of our carrying value of equity and the

estimated fair value of our business and consumer reporting units exceeded our carrying value of equity by 23%

and 8%, respectively.

For additional information on our goodwill balances by segment, see Note 2—Goodwill, Customer

Relationships and Other Intangible Assets in Item 8 of our Annual Report on Form 10-K for the year ended

December 31, 2015.

We may be required to assess our goodwill for impairment before our next required assessment date of

October 31, 2016 under certain circumstances, including any failure to meet our forecasted future operating

results or any significant increases in our weighted average cost of capital. In addition, we cannot assure that

adverse conditions will not trigger future goodwill impairment assessments or impairment charges. A number of

factors, many of which we cannot control, could affect our financial condition, operating results and business

prospects and could cause our actual results to differ from the estimates and assumptions we employed in our

goodwill impairment assessment. These factors include, but are not limited to, (i) further weakening in the

overall economy; (ii) a significant decline in our stock price and resulting market capitalization as a result of an

adverse change to our overall business operations; (iii) changes in the discount rate we use in our testing;

(iv) successful efforts by our competitors to gain market share in our markets; (v) adverse changes as a result of

regulatory or legislative actions; (vi) a significant adverse change in our legal affairs or in the overall business

B-22