CenturyLink 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

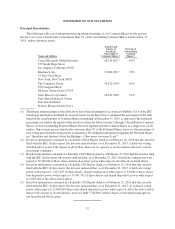

OWNERSHIP OF OUR SECURITIES

Principal Shareholders

The following table sets forth information regarding ownership of our Common Shares by the persons

known to us to have beneficially owned more than 5% of the outstanding Common Shares on December 31,

2015, unless otherwise noted.

Name and Address

Amount and

Nature of

Beneficial

Ownership of

Common Shares(1)

Percent of

Outstanding

Common

Shares(1)

Capital Research Global Investors

333 South Hope Street

Los Angeles, California 90071

48,149,891(2) 8.9%

Blackrock, Inc.

55 East 52nd Street

New York, New York 10055

37,806,201(3) 7.0%

The Vanguard Group

100 Vanguard Blvd.

Malvern, Pennsylvania 19355

34,532,950(4) 6.4%

State Street Corporation

State Street Financial Center

One Lincoln Street

Boston, Massachusetts 02111

30,545,540(5) 5.6%

(1) The figures and percentages in the table above have been determined in accordance with Rule 13d-3 of the SEC

based upon information furnished by investors listed, except that we have calculated the percentages in the table

based on the actual number of Common Shares outstanding on December 31, 2015, as opposed to the estimated

percentages set forth in the reports of the investors referred to below in notes 2 through 5. In addition to Common

Shares, we have outstanding Preferred Shares that vote together with the Common Shares as a single class on all

matters. One or more persons beneficially own more than 5% of the Preferred Shares; however, the percentage of

total voting power held by such persons is immaterial. For additional information regarding the Preferred Shares,

see “Questions and Answers About the Meeting — How many votes may I cast?”

(2) Based on information contained in a Schedule 13G/A Report dated as of February 16, 2016 that this investor

filed with the SEC. In this report, the investor indicated that, as of December 31, 2015, it held sole voting

and dispositive power with respect to all of these shares in its capacity as an investment adviser to various

investment companies.

(3) Based on information contained in a Schedule 13G/A Report dated as of February 10, 2016 that this investor filed

with the SEC. In this report, the investor indicated that, as of December 31, 2015, it held sole voting power with

respect to 32,949,648 of these shares and sole dispositive power with respect to all of the above-listed shares.

(4) Based on information contained in a Schedule 13G Report dated as of February 10, 2016 that this investor

filed with the SEC. In this report, the investor indicated that, as of December 31, 2015, it held sole voting

power with respect to 1,013,487 of these shares, shared voting power with respect to 54,000 of these shares,

sole dispositive power with respect to 33,447,702 of these shares and shared dispositive power with respect

to 1,085,248 of the above-listed shares.

(5) Based on information contained in a Schedule 13G Report dated as of February 12, 2016 that this investor

filed with the SEC. In this report, the investor indicated that, as of December 31, 2015, (i) it shared voting

power with respect to 22,960,650 shares and shared dispositive power with respect to all of the above-listed

shares with various of its subsidiaries and (ii) it held 7,584,886 of these shares as investment manager for

our broad-based 401(k) plans.

32