CenturyLink 2015 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We recognize revenues in our consolidated statements of operations for certain USF surcharges and

transaction taxes that we bill to our customers. Our consolidated statements of operations also reflect the related

expense for the amounts we remit to the government agencies. The total amount of such surcharges that we

included in revenues aggregated approximately $544 million, $526 million and $489 million for the years ended

December 31, 2015, 2014 and 2013, respectively. Those USF surcharges, where we record revenue, are included

in “other” operating revenues and transaction tax surcharges are included in “legacy services” revenues. We also

act as a collection agent for certain other USF and transaction taxes that we are required by government agencies

to include in our bills to customers, for which we do not record any revenue or expense because we only act as a

pass-through agent.

Allocations of Revenues and Expenses

Our segment revenues include all revenues from our strategic, legacy and data integration operations as

described in more detail above. Segment revenues are based upon each customer’s classification to an individual

segment. We report our segment revenues based upon all services provided to that segment’s customers. Our

segment expenses for our two segments include specific expenses incurred as a direct result of providing services

and products to segment customers, along with selling, general and administrative expenses that are directly

associated with specific segment customers or activities; and allocated expenses which include network

expenses, facilities expenses and other expenses such as fleet and real estate expenses. We do not assign

depreciation and amortization expense or impairments to our segments, as the related assets and capital

expenditures are centrally managed and are not monitored by or reported to the chief operating decision maker

(“CODM”) by segment. Generally speaking, severance expenses, restructuring expenses and certain centrally

managed administrative functions (such as finance, information technology, legal and human resources) are not

assigned to our segments. Interest expense is also excluded from segment results because we manage our

financing on a total company basis and have not allocated assets or debt to specific segments. Other income, net

is not monitored as a part of our segment operations and is therefore excluded from our segment results.

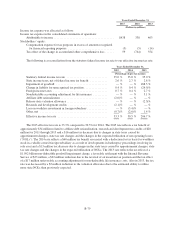

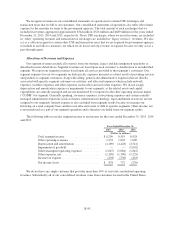

The following table reconciles segment income to net income for the years ended December 31, 2015, 2014

and 2013:

Years Ended December 31,

2015 2014 2013

(Dollars in millions)

Total segment income ....................... $8,209 8,519 8,928

Other operating revenues ..................... 1,232 1,003 1,000

Depreciation and amortization ................. (4,189) (4,428) (4,541)

Impairment of goodwill ...................... — — (1,092)

Other unassigned operating expenses ........... (2,647) (2,684) (2,842)

Other expenses, net ......................... (1,289) (1,300) (1,229)

Income tax expense ......................... (438) (338) (463)

Net income (loss) ........................... $ 878 772 (239)

We do not have any single customer that provides more than 10% of our total consolidated operating

revenues. Substantially all of our consolidated revenues come from customers located in the United States.

B-85