CenturyLink 2015 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Combined Pension Plan (“Combined Plan”). Pension benefits for participants of the new Combined Plan who are

represented by a collective bargaining agreement are based on negotiated schedules. All other participants’

pension benefits are based on each individual participant’s years of service and compensation. We also maintain

non-qualified pension plans for certain current and former highly compensated employees. We maintain post-

retirement benefit plans that provide health care and life insurance benefits for certain eligible retirees. We also

provide other post-employment benefits for eligible former employees. We use a December 31 measurement date

for all our plans.

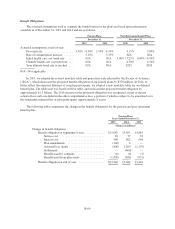

Pension Benefits

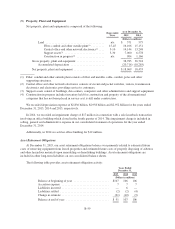

Current funding laws require a company with a pension shortfall to fund the annual cost of benefits earned

in addition to a seven-year amortization of the shortfall. Our funding policy for our Combined Plan is to make

contributions with the objective of accumulating sufficient assets to pay all qualified pension benefits when due

under the terms of the plan. The accounting unfunded status of our qualified pension plan was $2.215 billion and

$2.403 billion as of December 31, 2015 and 2014, respectively.

In 2015, we made a voluntary cash contribution of $100 million to our qualified pension plan and paid

approximately $6 million of benefits directly to participants of our non-qualified pension plans. Based on current

laws and circumstances, we are not required to make any contributions to our qualified pension plan in 2016, but

we estimate that we will pay approximately $5 million of benefits to participants of our non-qualified pension

plans.

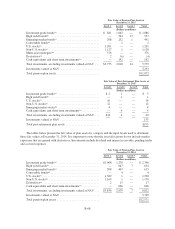

Our pension plans contain provisions that allow us, from time to time, to offer lump sum payment options to

certain former employees in settlement of their future retirement benefits. We record these payments as a

settlement only if, in the aggregate, they exceed the sum of the annual service and interest costs for the plan’s net

periodic pension benefit costs, which represents the settlement threshold. In September 2015, we offered to make

cash settlement payments in December 2015 to a group of former employees provided they accepted the offer by

the end of October 2015. During the fourth quarter of 2015, we made cash settlement payments for the lump sum

offer of approximately $356 million. The total amount of the lump sum settlement payments for the year ended

December 31, 2015, which included the lump sum offer and lump sum elections from employees who terminated

employment during the year, was less than the settlement threshold, therefore settlement accounting was not

triggered in 2015. On December 8, 2014, lump sum pension settlement payments to terminated, but not-yet-

retired legacy Qwest participants was $460 million, which exceeded the settlement threshold of $418 million. As

a result, we were required to recognize a settlement charge of $63 million in 2014 to accelerate the recognition of

a portion of the previously unrecognized actuarial losses in the qualified pension plan, which has been allocated

and reflected in cost of services and products (exclusive of depreciation and amortization) and selling, general

and administrative in our consolidated statement of operations for the year ended December 31, 2014. This

charge reduced our recorded net income and retained earnings, with an offset to accumulated other

comprehensive loss in shareholders’ equity. The amount of any future non-cash settlement charges will depend

on the level of lump sum benefit payments made in 2016 and beyond.

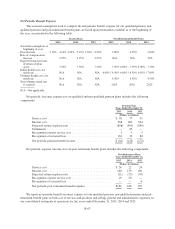

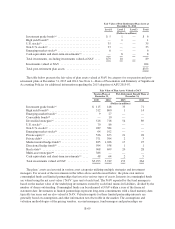

Post-Retirement Benefits

Our post-retirement benefit plans provide post-retirement benefits to qualified retirees and allow (i) eligible

employees retiring before certain dates to receive benefits at no or reduced cost and (ii) eligible employees

retiring after certain dates to receive benefits on a shared cost basis. The post-retirement benefits not paid by the

trust are funded by us and we expect to continue funding these post-retirement obligations as benefits are paid.

The accounting unfunded status of our qualified post-retirement benefit plan was $3.374 billion and $3.477

billion as of December 31, 2015 and 2014, respectively.

No contributions were made to the post-retirement trusts in 2015, and we do not expect to make a

contribution in 2016. However, in 2015 we paid approximately $116 million of benefits (net of participant

B-61