CenturyLink 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

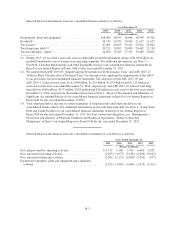

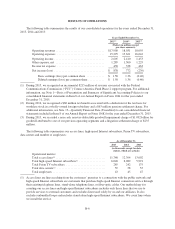

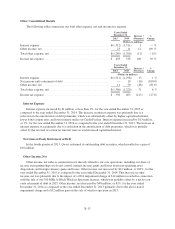

Years Ended

December 31, Increase /

(Decrease)

%

Change2014 2013

(Dollars in millions)

Cost of services and products (exclusive of depreciation and

amortization) ............................................. $ 7,846 7,507 339 5 %

Selling, general and administrative .............................. 3,347 3,502 (155) (4)%

Depreciation and amortization .................................. 4,428 4,541 (113) (2)%

Impairment of goodwill ....................................... — 1,092 (1,092) nm

Total operating expenses ...................................... $15,621 16,642 (1,021) (6)%

nm—Attributing changes in impairment of goodwill to the 2013 goodwill impairment charge are considered not

meaningful.

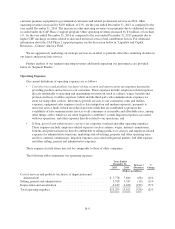

Cost of Services and Products (exclusive of depreciation and amortization)

Cost of services and products (exclusive of depreciation and amortization) decreased by $68 million, or 1%,

for the year ended December 31, 2015 as compared to the year ended December 31, 2014. Excluding the lower

customer premises equipment costs, cost of services and products increased by $56 million for the year ended

December 31, 2015 as compared to the year ended December 31, 2014. The increase in costs of services and

products was primarily due to increases in pension and postretirement costs, USF rate increases, higher network

expenses and increases in content costs for Prism TV. These increases were partially offset by decreases in

salaries and wages from lower headcount, professional fees and contract labor costs. Cost of services and

products (exclusive of depreciation and amortization) increased by $339 million, or 5%, for the year ended

December 31, 2014 as compared to the year ended December 31, 2013 primarily due to increases in employee-

related costs (which was significantly impacted by the below-noted lump sum pension payments), customer

premises equipment installation expenses related to the increase in data integration revenues, facility and network

costs, real estate and power costs and content costs for Prism TV.

Selling, General and Administrative

Selling, general and administrative expenses decreased by $19 million, or less than 1%, for the year ended

December 31, 2015 as compared to the year ended December 31, 2014. The decrease in selling, general and

administrative expenses was primarily due to lower benefit expenses, insurance costs and asset impairment

charges. These decreases were partially offset by increases in bad debt expense, external commissions and

regulatory fines of $15 million associated with a 911 system outage. Selling, general and administrative expenses

decreased by $155 million, or 4%, for the year ended December 31, 2014 as compared to the year ended

December 31, 2013 primarily due to a charge in 2013 of $235 million in connection with a litigation settlement.

The decrease was partially offset by increases in employee-related costs (including severance costs), insurance

costs and impairment charges related to office buildings sold and currently being held for sale.

Pension Lump Sum Offer

Our pension plan contains provisions that allow us, from time to time, to offer lump sum payment options to

certain former employees in settlement of their future retirement benefits. We record an accounting settlement

charge associated with these lump sum payments only if, in the aggregate, they exceed the sum of the annual

service and interest costs for the plan’s net periodic pension benefit cost, which represents the settlement

threshold. In September 2015, we offered to make cash settlement payments in December 2015 to a group of

former employees provided they accepted the offer by the end of October 2015. During the fourth quarter of

2015, we made cash settlement payments for the lump sum offer of approximately $356 million. The total

amount of the lump sum settlement payments for the year ended December 31, 2015, which included the lump

sum offer and lump sum elections from employees who terminated employment during the year, was less than

B-10