CenturyLink 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For information on our outstanding debt securities, see immediately below “Future Contractual Obligations”

and Note 3—Long-Term Debt and Credit Facilities to our consolidated financial statements in Item 8 of our

Annual Report on Form 10-K for the year ended December 31, 2015.

Future Contractual Obligations

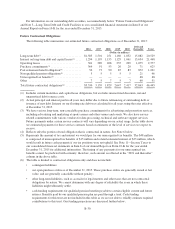

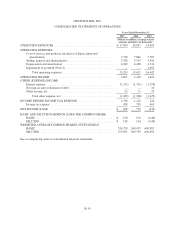

The following table summarizes our estimated future contractual obligations as of December 31, 2015:

2016 2017 2018 2019 2020

2021 and

thereafter Total

(Dollars in millions)

Long-term debt(1) ........................... $1,503 1,501 251 1,160 1,032 15,082 20,529

Interest on long-term debt and capital leases(2) .... 1,294 1,195 1,155 1,129 1,061 15,634 21,468

Operating leases ............................ 301 289 268 235 209 1,075 2,377

Purchase commitments(3) ..................... 364 91 53 26 20 71 625

Post-retirement benefit obligation(4) ............ 56 73 90 87 83 872 1,261

Non-qualified pension obligations(4) ............ 55555 21 46

Unrecognized tax benefits(5) .................. ————— 48 48

Other .................................... 75757 60 91

Total future contractual obligations(6) ........... $3,530 3,159 1,829 2,647 2,417 32,863 46,445

(1) Includes current maturities and capital lease obligations, but excludes unamortized discounts, net and

unamortized debt issuance costs.

(2) Actual principal and interest paid in all years may differ due to future refinancing of outstanding debt or

issuance of new debt. Interest on our floating rate debt was calculated for all years using the rates effective

at December 31, 2015.

(3) We have various long-term, non-cancelable purchase commitments for advertising and promotion services,

including advertising and marketing at sports arenas and other venues and events. We also have service

related commitments with various vendors for data processing, technical and software support services.

Future payments under certain service contracts will vary depending on our actual usage. In the table above

we estimated payments for these service contracts based on estimates of the level of services we expect to

receive.

(4) Reflects only the portion of total obligation that is contractual in nature. See Note 6 below.

(5) Represents the amount of tax and interest we would pay for our unrecognized tax benefits. The $48 million

is composed of unrecognized tax benefits of $15 million and related estimated interest of $33 million, which

would result in future cash payments if our tax positions were not upheld. See Note 11—Income Taxes to

our consolidated financial statements in Item 8 of our Annual Report on Form 10-K for the year ended

December 31, 2015 for additional information. The timing of any payments for our unrecognized tax

benefits cannot be predicted with certainty; therefore, such amount is reflected in the “2021 and thereafter”

column in the above table.

(6) The table is limited to contractual obligations only and does not include:

• contingent liabilities;

• our open purchase orders as of December 31, 2015. These purchase orders are generally issued at fair

value, and are generally cancelable without penalty;

• other long-term liabilities, such as accruals for legal matters and other taxes that are not contractual

obligations by nature. We cannot determine with any degree of reliability the years in which these

liabilities might ultimately settle;

• cash funding requirements for qualified pension benefits payable to certain eligible current and future

retirees. Benefits paid by our qualified pension plan are paid through a trust. Cash funding

requirements for this trust are not included in this table as we are not able to reliably estimate required

contributions to this trust. Our funding projections are discussed further below;

B-30