CenturyLink 2015 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

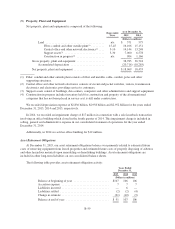

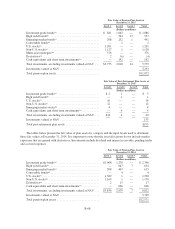

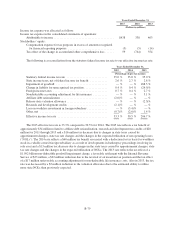

Fair Value of Post-Retirement Plan Assets at

December 31, 2014

Level 1 Level 2 Level 3 Total

(Dollars in millions)

Investment grade bonds(a) ............................. $ 5 1 — $ 6

High yield bonds(b) .................................. — 1 — 1

U.S. stocks(f) ....................................... 35 — — 35

Non-U.S. stocks(g) ................................... 33 — — 33

Emerging market stocks(h) ............................. 6 — — 6

Cash equivalents and short-term investments(o) ............ — 8 — 8

Total investments, excluding investments valued at NAV .... $79 10 — 89

Investments valued at NAV ........................... 264

Total post-retirement plan assets ....................... $353

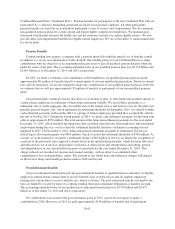

The table below presents the fair value of plan assets valued at NAV by category for our pension and post-

retirement plans at December 31, 2015 and 2014. See Note 1—Basis of Presentation and Summary of Significant

Accounting Policies for additional information regarding the 2015 adoption of ASU 2015-07.

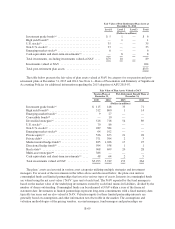

Fair Value of Plan Assets Valued at NAV

Pension Plans at

December 31,

Post-Retirement Benefit Plans at

December 31,

2015 2014 2015 2014

(Dollars in millions)

Investment grade bonds(a) $ 115 148 35 71

High yield bonds(b) .......................... 512 860 1 14

Emerging market bonds(c) ..................... 9 27 — —

Convertible bonds(d) ......................... — 10 — —

Diversified strategies(e) ....................... 516 718 54 89

U.S. stocks(f) ............................... 70 86 — —

Non-U.S. stocks(g) ........................... 289 384 — —

Emerging market stocks(h) .................... 64 102 — —

Private equity(i) ............................. 526 673 21 28

Private debt(j) ............................... 371 394 2 3

Market neutral hedge funds(k) .................. 825 1,026 17 25

Directional hedge funds(k) ..................... 594 558 1 1

Real estate(l) ............................... 968 699 20 28

Multi-asset strategies(m) ...................... 386 — — —

Cash equivalents and short-term investments(o) .... 48 64 2 5

Total investments valued at NAV .............. $5,293 5,749 153 264

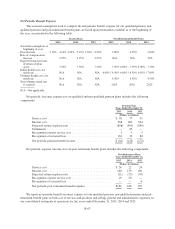

The plans’ assets are invested in various asset categories utilizing multiple strategies and investment

managers. For several of the investments in the tables above and discussed below, the plans own units in

commingled funds and limited partnerships that invest in various types of assets. Interests in commingled funds

are valued using the net asset value (“NAV”) per unit of each fund. The NAV reported by the fund manager is

based on the market value of the underlying investments owned by each fund, minus its liabilities, divided by the

number of shares outstanding. Commingled funds can be redeemed at NAV within a year of the financial

statement date. Investments in limited partnerships represent long-term commitments with a fixed maturity date,

typically ten years and are also valued at NAV. Valuation inputs for these limited partnership interests are

generally based on assumptions and other information not observable in the market. The assumptions and

valuation methodologies of the pricing vendors, account managers, fund managers and partnerships are

B-69