CenturyLink 2015 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

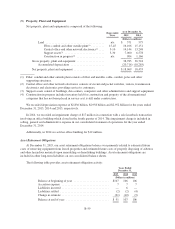

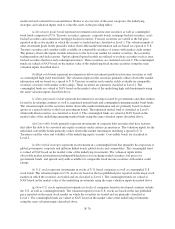

During 2015, 2014 and 2013, we revised our estimates for the cost of removal of network equipment,

asbestos remediation, and other obligations by $21 million, $10 million and $3 million, respectively. These

revisions resulted in a reduction of the asset retirement obligation and offsetting reduction to gross property,

plant and equipment and revisions to assets specifically identified are recorded as a reduction to accretion

expense.

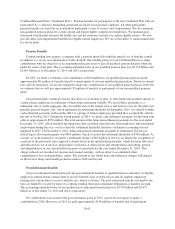

(6) Severance and Leased Real Estate

Periodically, we have reductions in our workforce and have accrued liabilities for the related severance

costs. These workforce reductions resulted primarily from the progression or completion of our post-acquisition

integration plans, increased competitive pressures, cost reduction initiatives and reduced workload demands due

to the loss of customers purchasing certain legacy services.

We report severance liabilities within accrued expenses and other liabilities—salaries and benefits in our

consolidated balance sheets and report severance expenses in cost of services and products and selling, general

and administrative expenses in our consolidated statements of operations. As noted in Note 12—Segment

Information, we do not allocate these severance expenses to our segments.

We have recognized liabilities to reflect our estimates of the fair values of the existing lease obligations for

real estate for which we have ceased using, net of estimated sublease rentals. Our fair value estimates were

determined using discounted cash flow methods. We recognize expense to reflect accretion of the discounted

liabilities and periodically, we adjust the expense when our actual subleasing experience differs from our initial

estimates. We report the current portion of liabilities for ceased-use real estate leases in accrued expenses and

other liabilities-other and report the noncurrent portion in deferred credits and other liabilities in our consolidated

balance sheets. We report the related expenses in selling, general and administrative expenses in our consolidated

statements of operations. At December 31, 2015, the current and noncurrent portions of our leased real estate

accrual were $9 million and $71 million, respectively. The remaining lease terms range from 0.3 years to 10

years, with a weighted average of 8 years.

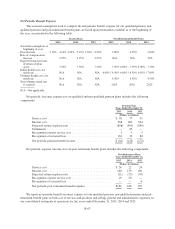

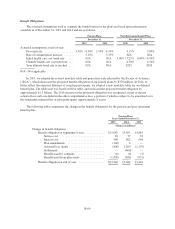

Changes in our accrued liabilities for severance expenses and leased real estate were as follows:

Severance Real Estate

(Dollars in millions)

Balance at December 31, 2013 ..................... $ 17 113

Accrued to expense .............................. 87 1

Payments, net ................................... (78) (16)

Reversals and adjustments ......................... — (2)

Balance at December 31, 2014 ..................... 26 96

Accrued to expense .............................. 96 —

Payments, net ................................... (108) (13)

Reversals and adjustments ......................... — (3)

Balance at December 31, 2015 ..................... $ 14 80

(7) Employee Benefits

Pension, Post-Retirement and Other Post-Employment Benefits

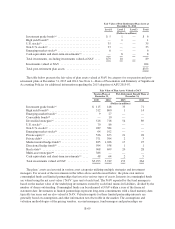

We sponsor various defined benefit pension plans (qualified and non-qualified), which in the aggregate

cover a substantial portion of our employees including legacy CenturyLink, legacy Qwest Communications

International, Inc. (“Qwest”) and legacy Embarq employees. On December 31, 2014, we merged our existing

qualified pension plans, which included merging the Qwest Pension Plan and Embarq Retirement Pension Plan

into the CenturyLink Retirement Plan. The CenturyLink Retirement Plan was renamed the CenturyLink

B-60