CenturyLink 2015 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

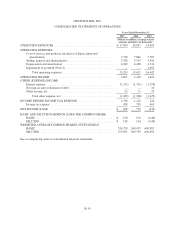

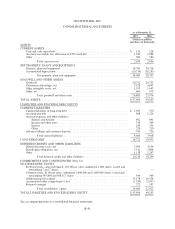

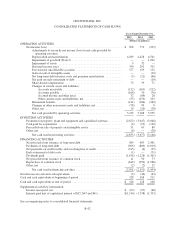

CENTURYLINK, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31,

2015 2014 2013

(Dollars in millions)

OPERATING ACTIVITIES

Net income (loss) .................................................. $ 878 772 (239)

Adjustments to reconcile net income (loss) to net cash provided by

operating activities:

Depreciation and amortization .................................... 4,189 4,428 4,541

Impairment of goodwill (Note 2) .................................. — — 1,092

Impairment of assets ........................................... 9 32 —

Deferred income taxes .......................................... 350 291 391

Provision for uncollectible accounts ............................... 177 159 152

Gain on sale of intangible assets .................................. — — (32)

Net long-term debt issuance costs and premium amortization ........... (3) (21) (46)

Net gain on early retirement of debt ............................... — — (10)

Share-based compensation ....................................... 73 79 71

Changes in current assets and liabilities:

Accounts receivable ........................................ (132) (163) (212)

Accounts payable .......................................... (168) 70 (76)

Accrued income and other taxes .............................. 32 (84) 28

Other current assets and liabilities, net ......................... (53) (270) 263

Retirement benefits ............................................ (141) (184) (342)

Changes in other noncurrent assets and liabilities, net ................. (78) 99 8

Other, net .................................................... 19 (20) (30)

Net cash provided by operating activities ........................... 5,152 5,188 5,559

INVESTING ACTIVITIES

Payments for property, plant and equipment and capitalized software ......... (2,872) (3,047) (3,048)

Cash paid for acquisitions ........................................... (4) (93) (160)

Proceeds from sale of property and intangible assets ...................... 31 63 80

Other, net ........................................................ (8) — (20)

Net cash used in investing activities ............................... (2,853) (3,077) (3,148)

FINANCING ACTIVITIES

Net proceeds from issuance of long-term debt ........................... 989 483 2,481

Payments of long-term debt .......................................... (966) (800) (2,010)

Net payments on credit facility and revolving line of credit ................. (315) (4) (95)

Early retirement of debt costs ........................................ (1) — (31)

Dividends paid .................................................... (1,198) (1,228) (1,301)

Net proceeds from issuance of common stock ............................ 11 50 73

Repurchase of common stock ........................................ (819) (650) (1,586)

Other, net ........................................................ (2) (2) 15

Net cash used in financing activities ............................... (2,301) (2,151) (2,454)

Net decrease in cash and cash equivalents ................................... (2) (40) (43)

Cash and cash equivalents at beginning of period ............................. 128 168 211

Cash and cash equivalents at end of period .................................. $ 126 128 168

Supplemental cash flow information:

Income taxes paid, net .............................................. $ (63) (27) (48)

Interest paid (net of capitalized interest of $52, $47 and $41) ................ $(1,310) (1,338) (1,333)

See accompanying notes to consolidated financial statements.

B-42