CenturyLink 2015 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

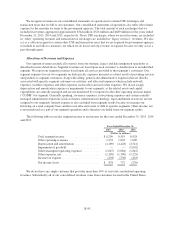

Purchase Commitments

We have several commitments primarily for marketing activities and support services from a variety of

vendors to be used in the ordinary course of business totaling $625 million at December 31, 2015. Of this

amount, we expect to purchase $364 million in 2016, $144 million in 2017 through 2018, $46 million in 2019

through 2020 and $71 million in 2021 and thereafter. These amounts do not represent our entire anticipated

purchases in the future, but represent only those items for which we were contractually committed as of

December 31, 2015.

(15) Other Financial Information

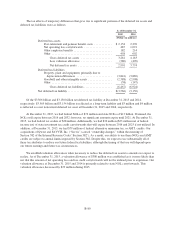

Other Current Assets

The following table presents details of other current assets in our consolidated balance sheets:

As of December 31,

2015 2014

(Dollars in millions)

Prepaid expenses .................................. $238 260

Materials, supplies and inventory ..................... 144 132

Assets held for sale ................................ 8 14

Deferred activation and installation charges ............. 105 103

Other ........................................... 86 71

Total other current assets ............................ $581 580

Assets held for sale includes several assets that we expect to sell within the next twelve months. During

2014, we sold our remaining 700 MHz A-Block wireless spectrum licenses, which we purchased in 2008 but

never placed into service. As a result of changes in market conditions and prevailing spectrum prices, we

recorded an impairment charge of $14 million, which is included in other income, net in our consolidated

statements of operations for the for the year ended December 31, 2014. The sale closed on November 3, 2014,

and we received $39 million in cash in the aggregate.

In January 2013, we sold $43 million of our wireless spectrum assets held for sale. The sale resulted in a

gain of $32 million, which is recorded as other income, net on our consolidated statements of operations.

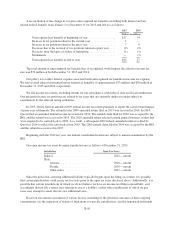

Selected Current Liabilities

Current liabilities reflected in our consolidated balance sheets include accounts payable and other current

liabilities as follows:

As of December 31

2015 2014

(Dollars in millions)

Accounts payable .................................. $968 1,226

Other current liabilities:

Accrued rent .................................. $ 32 34

Legal reserves ................................ 20 27

Other ....................................... 168 149

Total other current liabilities ..................... $220 210

Included in accounts payable at December 31, 2015 and 2014, were $68 million and $80 million,

respectively, representing book overdrafts and $94 million and $185 million, respectively, associated with capital

expenditures.

B-90