CenturyLink 2015 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

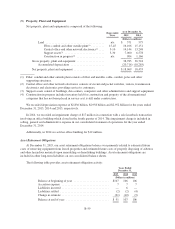

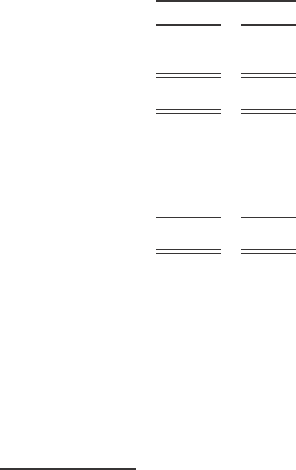

(2) Goodwill, Customer Relationships and Other Intangible Assets

Goodwill, customer relationships and other intangible assets consisted of the following:

As of December 31,

2015 2014

(Dollars in millions)

Goodwill ................................................................... $20,742 20,755

Customer relationships, less accumulated amortization of $5,648 and $4,682 ............. 3,928 4,893

Indefinite-life intangible assets .................................................. 269 268

Other intangible assets subject to amortization

Capitalized software, less accumulated amortization of $1,778 and $1,533 ........... 1,248 1,338

Trade names and patents, less accumulated amortization of $20 and $196 ............ 38 41

Total other intangible assets, net ......................................... $ 1,555 1,647

Total amortization expense for intangible assets for the years ended December 31, 2015, 2014 and 2013 was

$1.353 billion, $1.470 billion and $1.589 billion, respectively. As of December 31, 2015, the gross carrying

amount of goodwill, customer relationships, indefinite-life and other intangible assets was $33.671 billion.

We estimate that total amortization expense for intangible assets for the years ending December 31, 2016

through 2020 will be as follows:

(Dollars in millions)

2016 ...................................... $1,161

2017 ...................................... 1,056

2018 ...................................... 944

2019 ...................................... 827

2020 ...................................... 726

Our goodwill was derived from numerous acquisitions where the purchase price exceeded the fair value of

the net assets acquired.

We assess our goodwill and other indefinite-lived intangible assets for impairment annually, or, under

certain circumstances, more frequently, such as when events or changes in circumstances indicate there may be

impairment. We are required to write down the value of goodwill only when our assessment determines the

recorded amount of goodwill exceeds the fair value. Our annual impairment assessment date for goodwill is

October 31, at which date we assessed our reporting units, which are business (excluding wholesale), consumer

and wholesale. Our annual impairment assessment date for indefinite-lived intangible assets other than goodwill

is December 31.

Our reporting units are not discrete legal entities with discrete financial statements. Our assets and liabilities

are employed in and relate to the operations of multiple reporting units. For each reporting unit, we compare its

estimated fair value of equity to its carrying value of equity that we assign to the reporting unit. If the estimated

fair value of the reporting unit is greater than the carrying value, we conclude that no impairment exists. If the

estimated fair value of the reporting unit is less than the carrying value, a second calculation is required in which

the implied fair value of goodwill is compared to the carrying value of goodwill that we assigned to the reporting

unit. If the implied fair value of goodwill is less than its carrying value, goodwill must be written down to its

implied fair value.

At October 31, 2015, we estimated the fair value of our business (excluding wholesale), consumer and

wholesale reporting units by considering both a market approach and a discounted cash flow method, which

B-52