CenturyLink 2015 Annual Report Download - page 159

Download and view the complete annual report

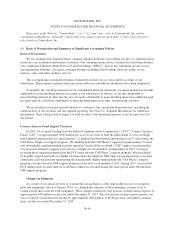

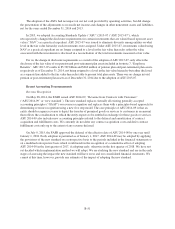

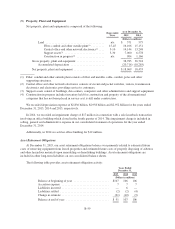

Please find page 159 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The adoption of the ASUs had no impact on our net cash provided by operating activities, but did change

the presentation of the adjustments to reconcile net income and changes in other noncurrent assets and liabilities,

net for the years ended December 31, 2014 and 2013.

In 2015, we adopted Accounting Standards Update (“ASU”) 2015-07 (“ASU 2015-07”), which

retrospectively changed the disclosure requirements for certain investments that are valued based upon net asset

value (“NAV”) as a practical expedient. ASU 2015-07 was issued to eliminate diversity among entities on what

level in the fair value hierarchy such investments were assigned. Under ASU 2015-07, investments valued using

NAV as a practical expedient are no longer assigned to a level in the fair value hierarchy rather the value

associated with the investments is disclosed in a reconciliation of the total investments measured at fair value.

For us, the change in disclosure requirements as a result of the adoption of ASU 2015-07, only affects the

disclosure of the fair value of our pension and post-retirement plan assets included in footnote 7, “Employee

Benefits”. ASU 2015-07 results in $5.749 billion and $264 million of pension plan and post-retirement plan assets,

respectively as of December 31, 2014, not being assigned to a level in the fair value hierarchy but rather disclosed

as a separate line added to the fair value hierarchy table to present total plan assets. There was no change in total

pension or post-retirement plan assets as of December 31, 2014 due to the adoption of ASU 2015-07.

Recent Accounting Pronouncements

Revenue Recognition

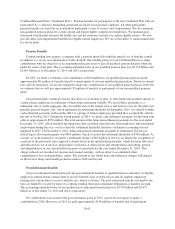

On May 28, 2014, the FASB issued ASU 2014-09, “Revenue from Contracts with Customers”

(“ASU 2014-09” or “new standard”). The new standard replaces virtually all existing generally accepted

accounting principles (“GAAP”) on revenue recognition and replaces them with a principles-based approach for

determining revenue recognition using a new five step model. The core principle of ASU 2014-09 is that an

entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount

that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

ASU 2014-09 also includes new accounting principles related to the deferral and amortization of contract

acquisition and fulfillment costs. We currently do not defer any contract acquisition costs and defer contract

fulfillment costs only up to the extent of any revenue deferred.

On July 9, 2015, the FASB approved the deferral of the effective date of ASU 2014-09 by one year until

January 1, 2018. Early adoption is permitted as of January 1, 2017. ASU 2014-09 may be adopted by applying

the provisions of the new standard on a retrospective basis to the periods included in the financial statements or

on a modified retrospective basis which would result in the recognition of a cumulative effect of adopting

ASU 2014-09 in the first quarter of 2017, if adopting early, otherwise in the first quarter of 2018. We have not

yet decided which implementation method we will adopt. We are studying the new standard and are in the early

stages of assessing the impact the new standard will have on us and our consolidated financial statements. We

cannot at this time, however, provide any estimate of the impact of adopting the new standard.

B-51