CenturyLink 2015 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

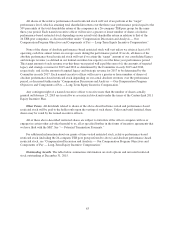

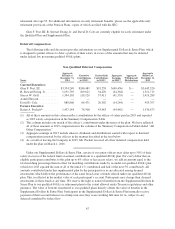

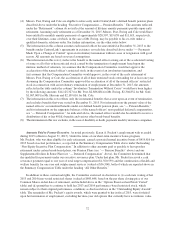

(4) Messrs. Post, Ewing and Cole are eligible to retire early under CenturyLink’s defined benefit pension plans

described above under the heading “Executive Compensation — Pension Benefits.” The amounts reflected

under the “Retirement” column do not reflect the amount of lifetime annuity payments payable upon early

retirement. Assuming early retirement as of December 31, 2015, Messrs. Post, Ewing and Cole would have

been entitled to monthly annuity payments of approximately $28,507, $19,638 and $11,619, respectively,

over their lifetimes, some of which, in the case of Mr. Ewing, may be payable to his ex-wife under a

qualified domestic relations order. For further information, see the other notes below.

(5) The information in this column assumes each named officer became entitled at December 31, 2015 to the

benefits under CenturyLink’s agreements in existence on such date described above under “— Payments

Made Upon a Change of Control” upon an involuntary termination without cause or resignation with good

reason. All amounts are based on several assumptions.

(6) The information in this row (i) reflects the benefit to the named officer arising out of the accelerated vesting

of some or all of his or her restricted stock caused by the termination of employment based upon the

intrinsic method of valuation, (ii) assumes that the Compensation Committee would not approve the

acceleration of the named officer’s restricted stock in the event of an involuntary termination, and

(iii) assumes that the Compensation Committee would approve, in the event of the early retirement of

Messrs. Post, Ewing or Cole, the acceleration of all of their restricted stock outstanding for at least one year.

Assuming the Compensation Committee approved the acceleration of all of the named officers’ restricted

stock in connection with an involuntary termination of employment at December 31, 2015, the amounts

reflected in the table under the column “Involuntary Termination Without Cause” would have been higher

by the following amounts: $14,125,327 for Mr. Post, $2,886,884 for Mr. Ewing, $2,304,832 for Mr. Goff,

$1,967,009 for Mr. Hussain and $2,109,616 for Mr. Cole.

(7) The information in this row reflects only the incremental benefits that accrue upon an event of termination,

and excludes benefits that were vested on December 31, 2015. For information on the present value of the

named officers’ accumulated benefits under our defined benefit pension plans, see “— Pension Benefits,”

and for information on the aggregate balances of the named officers’ non-qualified deferred compensation,

see “— Deferred Compensation.” As indicated above, the named officer would also be entitled to receive a

distribution of his or her 401(k) benefits and various other broad-based benefits.

(8) The information in this row excludes, in the case of disability or death, payments made by insurance companies.

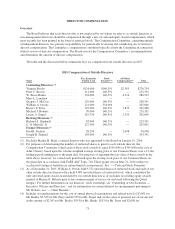

Amounts Paid to Former Executive. As noted previously, Karen A. Puckett’s employment with us ended

during 2015 (effective August 31, 2015). Under the terms of our short-term incentive bonus program,

Ms. Puckett, who was then eligible for early retirement, earned a prorated annual incentive bonus of $419,816 for

2015 based on actual performance, as reported in the Summary Compensation Table above under the heading

“Non-Equity Incentive Plan Compensation.” In addition to other amounts paid or payable to her upon her

retirement under certain broad-based plans, our Pension Plans (see “— Pension Benefits” above) and our

Supplemental Dollars & Sense Plan (see “— Deferred Compensation” above), the Committee determined that

she qualified for payments under our executive severance plan. Under that plan, Ms. Puckett received a cash

severance payment equal to one year of total target compensation ($1,560,599) and the continuation of health and

welfare benefits for one year and outplacement services (valued at $36,500), both of which are reported above in

the Summary Compensation Table under the heading “All Other Benefits.”

In addition to these contractual rights, the Committee exercised its discretion to (i) accelerate vesting of her

2013 and 2014 time-vested restricted shares (valued at $843,648, based on the per share closing price of our

Common Shares on her date of retirement, and included above in the “Options Exercised and Stock Vested”

table) and (ii) permit her to continue to hold her 2013 and 2014 performance-based restricted stock, which

remain subject to their original performance conditions as disclosed above in the “Outstanding Equity Awards”

table. The remainder of Ms. Puckett’s equity awards, which were granted to her in fiscal 2015, were forfeited

upon her termination of employment, excluding her nine-year old options that currently have no intrinsic value.

72