CenturyLink 2015 Annual Report Download - page 135

Download and view the complete annual report

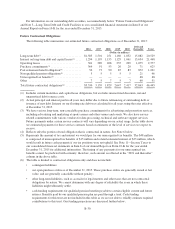

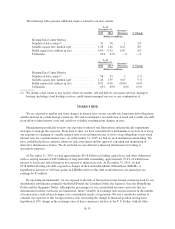

Please find page 135 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2016. Generally speaking, our principal funding source is cash from operating activities and our principal cash

requirements include operating expenses, capital expenditures, income taxes, debt repayments, dividends,

periodic stock repurchases and periodic pension contributions.

Based on our current capital allocation objectives, during 2016 we anticipate expending approximately

$3.0 billion of cash for capital investment in property, plant and equipment and up to $1.2 billion for dividends

on our common stock, based on the current annual common stock dividend rate of $2.16 and the current number

of outstanding common shares. During 2016, we have debt maturities of approximately $1.4 billion, scheduled

debt principal payments of approximately $22 million and capital lease and other fixed payments of

approximately $62 million.

We will continue to monitor our future sources and uses of cash, and anticipate that we will make

adjustments to our capital allocation strategies when, as and if determined by our Board of Directors. We

typically use our revolving credit facility as a source of liquidity for operating activities and our other cash

requirements.

Connect America Fund

In 2015, we accepted CAF funding from the FCC of approximately $500 million per year for six years to

fund the deployment of voice and high-speed Internet infrastructure for approximately 1.2 million rural

households and businesses in 33 states under the CAF Phase 2 support program. The funding from the CAF

Phase 2 support program is expected to substantially supplant the funding we previously received from the

interstate USF program that we previously utilized to support voice services in high-cost rural markets in these

33 states. In September of 2015, we began receiving these payments from the FCC under the new CAF Phase 2

support program, which included (i) monthly support payments at a higher rate than under the interstate USF

support program and (ii) a one-time cumulative catch-up payment representing the incrementally higher funding

under the CAF Phase 2 support program over the interstate USF Support program for the first seven months of

2015. During 2015, we received $209 million more cash than we would have otherwise received during the same

period under the interstate USF support program.

We declined annual funding of approximately $10 million in four states, and we expect the funding from the

CAF Phase 2 support program for these four states will be auctioned by the FCC, perhaps in the latter part of

2016. In these four states, the interstate USF support we have historically received is expected to continue until

the CAF Phase 2 auctions are completed.

As a result of accepting CAF Phase 2 support payments for 33 states, we will be obligated to make

substantial capital expenditures to build infrastructure. See “Capital Expenditures” below.

For additional information on the FCC’s CAF order and the USF program, see “Business—Regulation” in

Item 1 of our Annual Report on Form 10-K for the year ended December 31, 2015. See “Risk Factors—Risks

Affecting our Liquidity and Capital Resources” in Item 1A of our Annual Report on Form 10-K for the year

ended December 31, 2015.

In 2013, under the second round of the first phase of the CAF program, we received $40 million in funding

for deployment of broadband services in rural areas. The CAF Phase 2 support program overlaps certain eligible

areas of the second round of CAF 1 funding, and we are continuing to evaluate how much of the $40 million in

funding we will utilize or return to the FCC. As of the date of our Annual Report on Form 10-K for the year

ended December 31, 2015, we are past one of the benchmark deadlines for completing a portion of the broadband

deployment. Due to the delays we encountered in evaluating the eligible areas, we have requested relief and an

extension of the deadline with the FCC. If the FCC does not grant us relief, we will be requested to refund a

substantial portion of the $40 million in funding we received. This $40 million of CAF 1 Round 2 funding is

included in other noncurrent liabilities on our consolidated balance sheet as of December 31, 2015.

B-27