CenturyLink 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

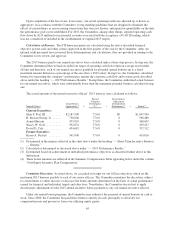

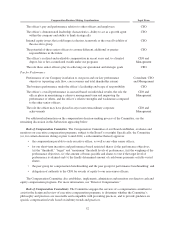

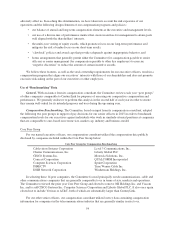

During 2015, the Committee granted our named officers the following number of (i) restricted shares that

will vest over a three-year period principally in exchange for continued service (“time-vested restricted shares”),

(ii) performance-based restricted shares that will vest in 2018 based on our relative total shareholder return (the

“TSR performance-based restricted shares”) and (iii) performance-based restricted shares that will vest in 2018

principally based on our attainment of absolute revenue targets over the above-described three-year performance

period (the “absolute revenue performance-based restricted shares”):

Performance-Based Restricted Shares

Named Officer

Time-Vested Restricted

Shares

No. of TSR

Performance-

Based

Restricted

Shares(2)

No. of

Absolute

Revenue

Performance-

Based

Restricted

Shares(2)

Fair

Value(1)

Total Fair

Value(1)

No. of

Shares Fair Value(1)

Current Executives:

Glen F. Post, III ................ 87,760 $3,400,000 65,820 65,820 $5,100,000 $8,500,000

R. Stewart Ewing, Jr. ............ 16,106 624,000 12,080 12,080 936,000 1,560,000

Aamir Hussain ................. 14,454 560,000 10,841 10,841 840,000 1,400,000

Stacey W. Goff ................ 13,009 504,000 9,757 9,757 756,000 1,260,000

David D. Cole ................. 11,770 456,000 8,827 8,828 684,000 1,140,000

Former Executive:

Karen A. Puckett(3) ............. 23,579 913,500 17,684 17,685 1,370,250 2,283,750

(1) For purposes of these grants, we determined both the number of time-vested and performance-based

restricted shares by dividing the total fair value granted to the executive by the volume-weighted average

closing price of our Common Shares over a 15-trading day period ending five trading days prior to the grant

date. In the Summary Compensation Table, however, our 2015 grants of time-vested restricted stock are

valued based on the closing stock price of our Common Shares on the day of grant, and our 2015 grants of

performance-based restricted shares are valued as of the grant date based on probable outcomes, in each

case in accordance with mandated SEC disclosure rules. See footnote 1 to the Summary Compensation

Table for more information.

(2) Based on the number of restricted shares granted in 2015. As discussed further below, the actual number of

shares that vests in the future may be lower or higher.

(3) Ms. Puckett forfeited receipt of all of these shares upon the termination of her employment on August 31,

2015.

Types of Awards. We strive to pay equity compensation in forms that create appropriate incentives to

optimize performance at reasonable cost, that minimize enterprise risk, that align the interests of our officers and

shareholders, that foster our long-term financial and strategic objectives and that are competitive with incentives

offered by other companies. Since 2008, the Committee has elected to issue all of our long-term equity

compensation grants in the form of restricted stock for a variety of reasons, including:

• the Committee’s recognition of the prevalent use of restricted stock by our peers,

• the Committee’s desire to minimize the dilution associated with our rewards, and

• the retentive value of restricted stock under varying market conditions.

In an effort to increase the link between our performance and executive compensation, since 2010, the

Committee has issued at least half of the value of our senior officers’ long-term awards in the form of

performance-based restricted stock, with the rest being in the form of time-vested restricted stock.

For additional information on the vesting and other terms of our equity awards (including certain voluntary

limits on the number of performance-based restricted shares that vest if our total shareholder return over the

48