CenturyLink 2015 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and interest on the Notes, discounted to the redemption date in the manner described in the Notes, plus accrued

and unpaid interest to the redemption date. At any time on or after January 1, 2025, CenturyLink, Inc. may

redeem the Notes at par plus accrued and unpaid interest to the redemption date. In addition, at any time on or

prior to April 1, 2018, CenturyLink, Inc. may redeem up to 35% of the principal amount of the Notes at a

redemption price equal to 105.625% of the principal amount thereof, plus accrued and unpaid interest to the

redemption date, with net cash proceeds of certain equity offerings. Under certain circumstances, CenturyLink,

Inc. will be required to make an offer to repurchase the Notes at a price of 101% of the aggregate principal

amount plus accrued and unpaid interest to the repurchase date. In October 2015, CenturyLink, Inc. exchanged

all of the unregistered Notes issued on March 19, 2015 for fully-registered Notes.

2014

On September 29, 2014, Qwest Corporation issued $500 million aggregate principal amount of 6.875%

Notes due 2054, in exchange for net proceeds, after deducting underwriting discounts and other expenses, of

$483 million. The Notes are senior unsecured obligations and may be redeemed, in whole or in part, on or after

October 1, 2019, at a redemption price equal to 100% of the principal amount redeemed plus accrued and unpaid

interest to the redemption date.

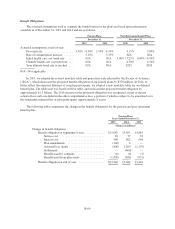

Repayments

2015

On October 13, 2015, Qwest Corporation redeemed all $250 million of its 7.2% Notes due 2026, which

resulted in an immaterial gain, and redeemed $150 million of its 6.875% Notes due 2033, which resulted in an

immaterial loss.

On June 15, 2015, Qwest Corporation paid at maturity the $92 million principal amount of its 7.625%

Notes.

On February 17, 2015, CenturyLink, Inc. paid at maturity the $350 million principal and accrued and unpaid

interest due under its Series M 5.00% Notes.

2014

On October 1, 2014, Qwest Corporation paid at maturity the $600 million principal amount of its 7.50%

Notes.

On April 1, 2014, a subsidiary of Embarq paid at maturity the $30 million principal amount of its 7.46%

first mortgage bonds.

Credit Facility

On December 3, 2014, we amended our existing $2 billion revolving credit facility to extend the maturity

date to December 3, 2019. The amended Credit Facility (the “Credit Facility”) has 16 lenders, each with

commitments ranging from $3.5 million to $198.5 million. The Credit Facility allows us to obtain revolving

loans and to issue up to $400 million of letters of credit, which upon issuance reduce the amount available for

other extensions of credit. Interest is assessed on borrowings using either the LIBOR or the base rate (each as

defined in the Credit Facility) plus an applicable margin between 1.00% and 2.25% per annum for LIBOR loans

and 0.00% and 1.25% per annum for base rate loans depending on our then current senior unsecured long-term

debt rating. Our obligations under the Credit Facility are guaranteed by nine of our subsidiaries.

B-55