CenturyLink 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 CenturyLink annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Supporting Statement: Equity-based compensation is an important component of senior executive

compensation at our Company. While we encourage the use of equity-based compensation for senior

executives, we are concerned that our Company’s senior executives are generally free to sell shares received

from our Company’s equity compensation plans. In our opinion, the Company’s current share ownership

guidelines for its senior executives do not go far enough to ensure that the Company’s equity compensation

plans continue to build stock ownership by senior executives over the long-term.

For example, our Company’s share ownership guidelines require the CEO to hold an amount of shares

equivalent to six times his base salary, or approximately 247,191 shares based on the current trading price.

In comparison, the CEO currently owns more than 1.3 million shares. In other words, the CEO’s total shares

held are five times greater than the share ownership requirement. What’s more, in 2014, our Company

granted the CEO 103,611 time-vested stock awards and 77,708 performance-based stock awards. In other

words, one year’s worth of equity awards is close to meeting the Company’s long-term share ownership

guidelines for the CEO.

We believe that requiring senior executives to only hold shares equal to a set target loses effectiveness

over time. After satisfying these target holding requirements, senior executives are free to sell all the

additional shares they receive in equity compensation.

Our proposal seeks to better link executive compensation with long-term performance by requiring a

meaningful share retention ratio for shares received by senior executives from the Company’s equity

compensation plans. A 2009 report by the Conference Board Task Force on Executive Compensation

observed that such hold-through-retirement requirements give executives ‘an ever growing incentive to

focus on long-term stock price performance as the equity subject to the policy increases’ (available at

http://www.conference-board.org/pdf_free/ExecCompensation2009.pdf).

We urge shareholders to vote FOR this proposal.”

The Board recommends that you vote AGAINST this proposal for the following reasons:

For the fourth consecutive year (and for the fifth time in six years), you are being asked to vote on this same

topic. The proponent’s proposal this year is substantially similar to its proposal in prior years. None of those

proposals has ever received the support of more than 27% of the shares voted at our annual meetings. For the

reasons discussed below, we continue to believe that our existing compensation policies adequately address the

concerns addressed in this proposal.

The Board strongly agrees with the proponent that equity ownership by executive officers serves to align the

long-term interests of our senior executives and shareholders. We believe, however, that sensible stock

ownership and compensation programs balance the importance of aligning the long-term interests of executives

and shareholders with the need to permit executives and shareholders to prudently manage their personal

financial affairs. As described further below, the Board believes that our stock ownership guidelines, in

conjunction with our performance-based compensation plans and policies, successfully strike this balance

effectively, making the adoption of the current proposal unnecessary. By contrast, the rigid mandate inherent in

this proposal could be harmful in several respects, and put us at a competitive disadvantage for attracting and

retaining executive officers.

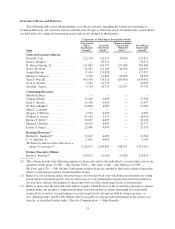

As the proponent acknowledges, our executives are already subject to share ownership requirements. Our

stock ownership guidelines (which are discussed further in “Corporate Governance — Governance Guidelines”

and “Compensation Discussion and Analysis — Our Policies, Processes and Guidelines Related to Executive

Compensation — Stock Ownership Guidelines”) mandate significant stock ownership for all of our executives.

As noted in the proponent’s supporting statement, these guidelines require our CEO to beneficially own

CenturyLink stock with a value of at least six times his annual base salary, and further require all other executive

officers to beneficially own CenturyLink stock with a value of at least three times their annual base salary. All of

our top executives own CenturyLink stock at levels well in excess of these requirements. For instance, our CEO

30